Your Credit Score: The Unseen Force Behind Your Car Insurance Rates

When shopping for car insurance, we tend to focus on the obvious factors that affect our premiums – the type of vehicle we drive, our driving record, and our level of coverage. However, there’s another crucial element that plays a significant role in determining our car insurance rates, yet often flies under the radar: our credit score.

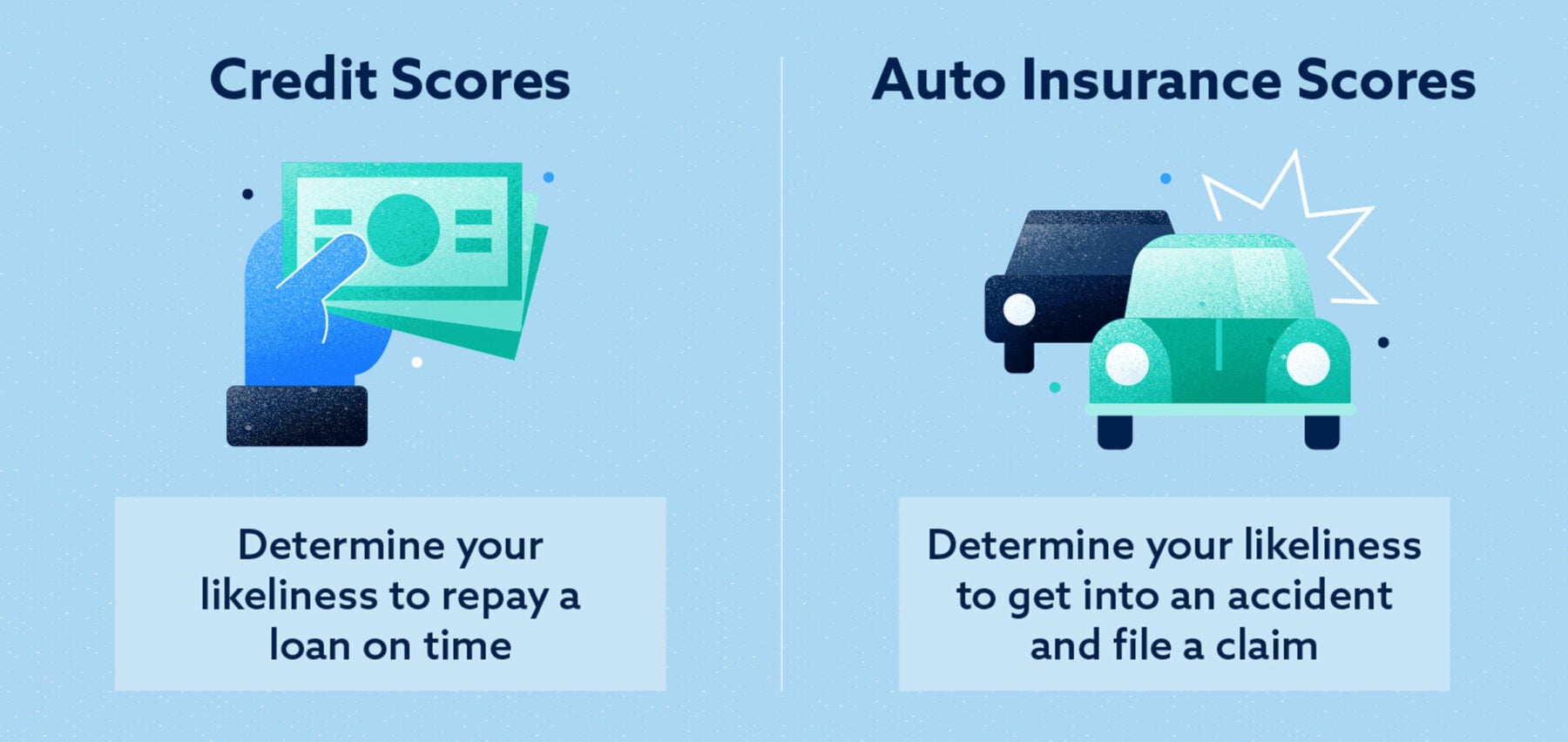

Yes, you read that right – your credit score can have a substantial impact on how much you pay for car insurance. This might seem counterintuitive, as credit scores are typically associated with loan and credit applications, not insurance premiums. But, as we’ll explore in this article, there’s a surprising connection between our creditworthiness and our ability to manage risk on the road.

What’s the Connection?

In the early 1990s, insurers began to analyze data on policyholders and discovered an intriguing correlation: people with good credit scores were less likely to file insurance claims. This revelation led to the widespread practice of using credit scores as a factor in determining car insurance rates.

The reasoning behind this is twofold:

- Financial stability: A good credit score indicates that you’re responsible with your finances and able to manage debt effectively. Insurers see this as a positive trait, as it suggests that you’ll be more likely to pay your premiums on time and avoid financial difficulties.

- Risk management: A person with a good credit score is perceived as being more cautious and risk-averse. This translates to their behavior on the road, where they’re less likely to engage in reckless or impulsive driving habits that increase the likelihood of accidents.

How Much of an Impact Does Credit Score Have?

The extent to which your credit score affects your car insurance rates varies by state and insurer. However, research suggests that credit score can account for up to 20% of the factors that determine your premium. To put this into perspective, here’s a rough breakdown of how credit score can influence your car insurance rates:

- Excellent credit (750+): You may enjoy a 10-20% discount on your premiums.

- Good credit (700-749): You might receive a 5-10% discount.

- Fair credit (650-699): Your premiums might remain unaffected or increase by up to 5%.

- Poor credit (600-649): Expect to pay 10-20% more than average.

- Bad credit (below 600): Your premiums could skyrocket by 20-50% or more.

It’s essential to remember that credit score is just one of many factors that insurers consider when calculating your premium. Your age, driving history, vehicle type, and coverage levels still play a significant role in determining your overall rate.

What Can You Do?

If you’re concerned about how your credit score is impacting your car insurance rates, here are some steps you can take:

- Check your credit report: Ensure there are no errors or inaccuracies on your report, which could be dragging down your credit score.

- Improve your credit score: Focus on making timely payments, keeping credit utilization low, and avoiding unnecessary credit inquiries.

- Shop around: Compare car insurance quotes from multiple providers to find the best rates for your credit profile.

- Consider a usage-based insurance: If you have a poor credit score, you might benefit from a usage-based insurance policy that focuses on your driving habits rather than your creditworthiness.

In conclusion, while credit score might seem like an unrelated factor in determining car insurance rates, its impact can be substantial. By understanding the connection between creditworthiness and risk management, you can take steps to improve your credit score and potentially save hundreds on your car insurance premiums. So, the next time you’re shopping for car insurance, remember to factor in the power of your credit score.