Imagine you’re enjoying a lovely evening walk in the park when suddenly, a strong gust of wind blows, and a tree branch hits you, causing severe injuries. You’re rushed to the hospital, and after a series of tests, you’re left with a hefty medical bill that exceeds your health insurance policy limits. On top of that, the homeowner’s insurance of the park doesn’t cover the full amount of damages you’ve incurred. This is where umbrella insurance comes in – a type of coverage that protects you from unexpected and costly events. But, what exactly is umbrella insurance, and do you need it?

The Basics of Umbrella Insurance

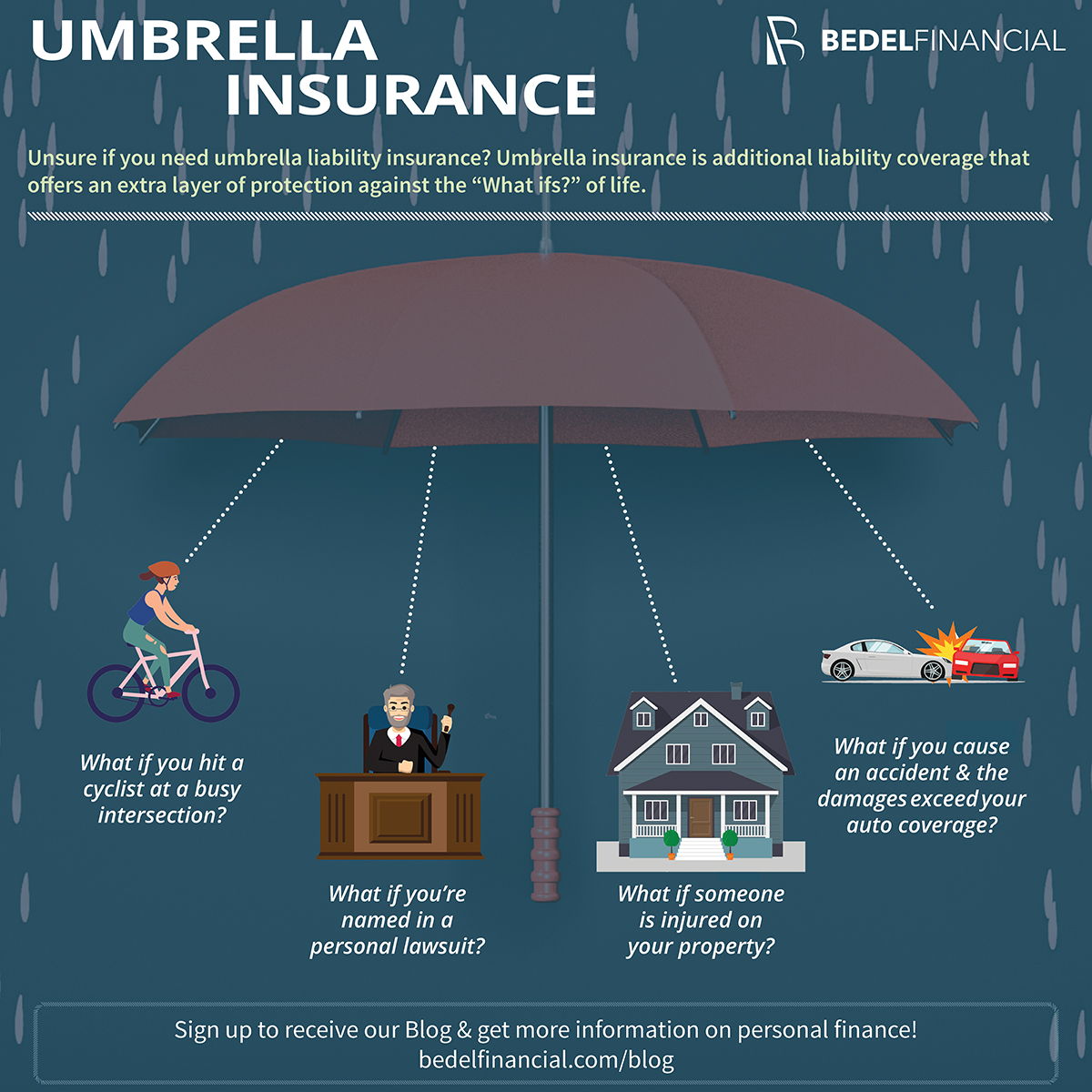

Umbrella insurance is a type of liability insurance that provides additional coverage beyond the limits of your existing policies, such as home, auto, or renters insurance. It’s called "umbrella" because it covers a wide range of situations, much like an umbrella protects you from the rain. This type of insurance is designed to shield your assets from unpredictable events, such as injuries to others, property damage, or costly lawsuits.

How Does Umbrella Insurance Work?

Here’s an example:

- Let’s say you have a home insurance policy with a liability limit of $300,000.

- You’re hosting a backyard barbecue, and one of your guests slips on a patch of ice and breaks their ankle.

- The guest sues you for $500,000, claiming you were negligent in maintaining your property.

Your home insurance policy would cover the initial $300,000, but you’d be left with $200,000 in uninsured damages. This is where umbrella insurance kicks in, covering the remaining amount.

What Does Umbrella Insurance Cover?

Umbrella insurance can cover a range of situations, including:

- Bodily injury or death

- Property damage

- Libel or slander

- False arrest or detention

- Malicious prosecution

- Rental properties

Is Umbrella Insurance Right for You?

If you’re wondering whether you need umbrella insurance, consider the following:

- Do you have significant assets, such as a home, investments, or retirement savings?

- Do you have a high income or high-value possessions?

- Do you engage in high-risk activities, such as boating or skiing?

- Do you own rental properties or host events that could put you at risk of liability?

If you answered "yes" to any of these questions, umbrella insurance might be a wise investment.