As the world of ride-sharing continues to grow, many individuals are turning to companies like Uber to supplement their income. However, driving for Uber can be a bit of a gray area when it comes to auto insurance. If you’re an Uber driver, you’re likely wondering what’s covered under your auto insurance policy and what’s not.

The good news is that Uber does offer some level of insurance protection for its drivers. The bad news is that it’s not always clear-cut. In this article, we’ll break down what’s typically covered under auto insurance for Uber drivers and what you need to know to protect yourself on the road.

Uber’s Insurance Coverage

Uber offers a few different types of insurance coverage for its drivers. These include:

- Liability Coverage: This type of coverage kicks in when you’re driving and are found to be at fault for an accident. Uber’s liability coverage will typically cover damages to other vehicles or property, as well as medical expenses for injuries sustained by other drivers or passengers.

- Uninsured/Underinsured Motorist Coverage: If you’re involved in an accident with another driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages, Uber’s uninsured/underinsured motorist coverage can help fill the gap.

- Collision Coverage: This type of coverage applies when you’re driving and are involved in an accident that causes damage to your vehicle.

- Comprehensive Coverage: This type of coverage applies when your vehicle is damaged due to something other than a collision, such as theft, vandalism, or natural disasters.

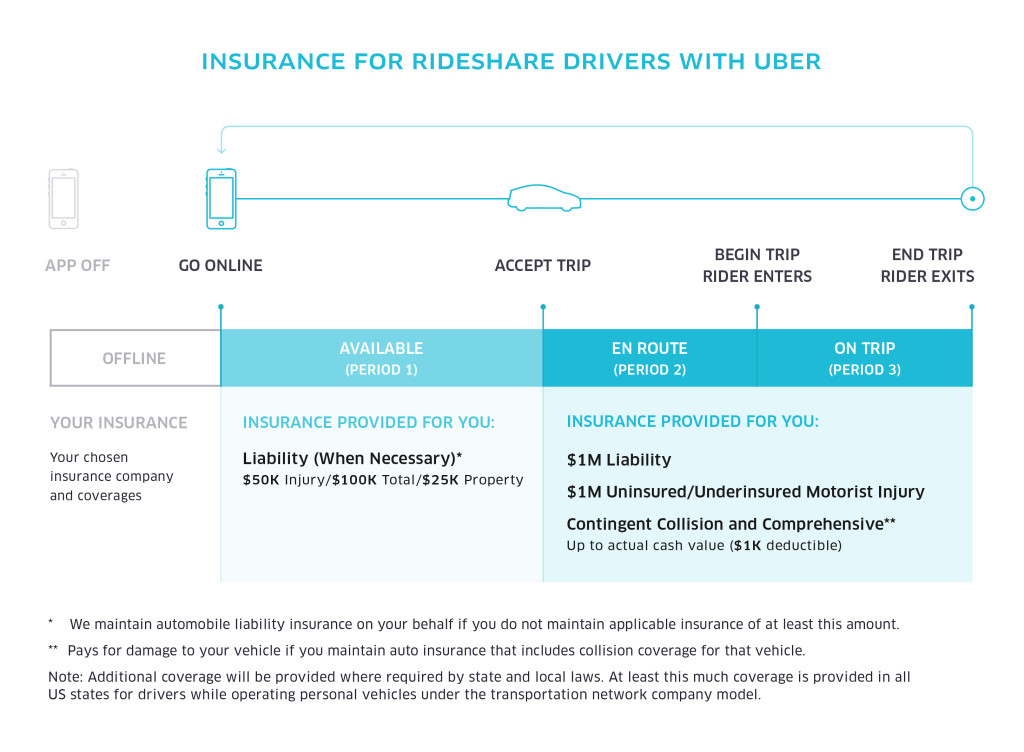

However, there are some important limitations to keep in mind when it comes to Uber’s insurance coverage. For one, the coverage only applies when you’re actively driving for Uber and have a passenger in the car. If you’re driving to or from a pickup, or if you’re driving with the app on but don’t have a passenger, you may not be covered.

Gaps in Coverage

One of the biggest challenges for Uber drivers is dealing with gaps in coverage. When you’re driving for Uber, you may be considered to be in one of three different periods:

- Period 1: This is the time when you have the app on, but you haven’t yet accepted a ride. During this period, you’re not typically covered under Uber’s insurance policy, and you may be considered to be driving for personal use.

- Period 2: This is the time when you’ve accepted a ride and are driving to pick up a passenger. During this period, you’re typically covered under Uber’s liability coverage, but you may not be covered for physical damage to your vehicle.

- Period 3: This is the time when you have a passenger in the car and are actively driving. During this period, you’re typically fully covered under Uber’s insurance policy.

The problem with these periods is that there can be some gray area when it comes to determining which period you’re in. For example, if you’re driving with the app on and are involved in an accident, it may not be clear whether you’re in Period 1 or Period 2.

What to Do

If you’re an Uber driver, there are a few things you can do to protect yourself and ensure that you have adequate insurance coverage:

- Read Your Policy: Take a close look at your auto insurance policy and make sure you understand what’s covered and what’s not.

- Consider a Ride-Sharing Endorsement: Many insurance companies offer specialized endorsements for ride-sharing drivers. These endorsements can help fill the gaps in coverage and provide additional protection.

- Don’t Rely on Uber’s Coverage Alone: While Uber’s insurance coverage can be helpful, it’s not always enough. Make sure you have adequate coverage of your own to protect yourself and your vehicle.

Driving for Uber can be a great way to make extra money, but it’s not without its risks. By understanding what’s covered under your auto insurance policy and taking steps to protect yourself, you can help minimize those risks and drive with confidence.