Navigating the World of Health Insurance: HMOs vs PPOs

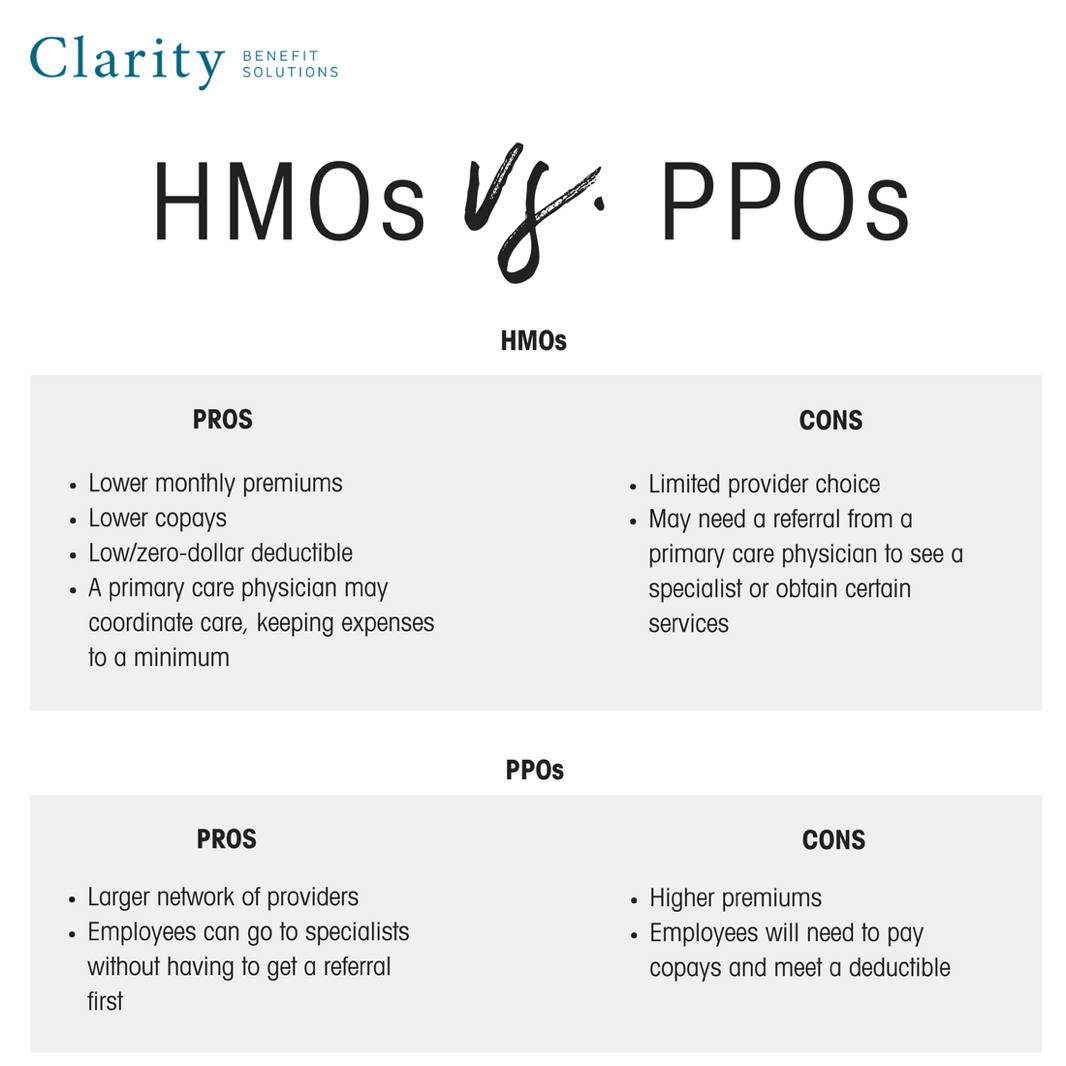

When it comes to choosing a health insurance plan, the numerous options available can be overwhelming, especially for those who are new to the process. Two of the most popular types of plans on the market are HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations). While both have their own set of benefits and drawbacks, understanding the differences between them is key to making an informed decision that suits your unique needs and budget.

The Basics: What are HMOs and PPOs?

To begin with, let’s explore what these two types of plans are all about.

HMOs are a type of health insurance plan that provides coverage to members within a specified network of healthcare providers. These plans typically require you to choose a primary care physician (PCP) who will be your first point of contact for all your medical needs. Your PCP will then coordinate your care and provide referrals to specialists within the network if needed.

On the other hand, PPOs are a type of plan that allows you to receive care from both in-network and out-of-network healthcare providers. These plans do not require you to choose a PCP and provide more flexibility when it comes to seeking care from specialists.

Key Differences: HMOs vs PPOs

Now that we have a basic understanding of what HMOs and PPOs are, let’s dive into the key differences between the two.

-

Network and Provider Choice: As mentioned earlier, HMOs have a more restrictive network of providers. You’ll need to choose a PCP and receive referrals to specialists within the network. PPOs, on the other hand, offer more flexibility with a larger network of providers and the ability to see out-of-network specialists without a referral.

-

Out-of-Network Coverage: Speaking of out-of-network care, PPOs typically cover a percentage of medical bills when you see an out-of-network provider. HMOs, however, usually don’t cover out-of-network care, except in emergency situations.

-

Cost and Premiums: HMOs are often more affordable than PPOs in terms of premiums. This is because HMOs have a more restrictive network, which allows them to negotiate lower rates with providers. PPOs, with their larger network and more flexibility, tend to have higher premiums.

-

Referrals and Approvals: HMOs often require referrals from your PCP before you can see a specialist. This can be time-consuming and may delay your care. PPOs, on the other hand, do not require referrals, making it easier to see a specialist when needed.

-

Maximum Out-of-Pocket Costs: Both HMOs and PPOs have a maximum out-of-pocket (MOOP) cost, which is the maximum amount you’ll pay for healthcare expenses within a calendar year. However, PPOs tend to have higher MOOPs than HMOs.

Which Plan is Right for You?

So, how do you decide between an HMO and a PPO? The answer ultimately depends on your individual needs and priorities. If you:

- Are looking for a more affordable option

- Are willing to choose a PCP and receive referrals to specialists