Navigating the world of health insurance can be a daunting task, especially when it comes to choosing the right plan for your needs. One type of plan that has gained popularity in recent years is the high-deductible health plan (HDHP). But is this type of plan right for you?

To answer this question, let’s first break down what a high-deductible health plan is. An HDHP is a type of health insurance plan that has a lower premium (the amount you pay each month) but a higher deductible (the amount you pay out-of-pocket before your insurance kicks in). For 2023, the IRS defines a high-deductible health plan as one with a deductible of at least $1,500 for an individual or $3,000 for a family.

The idea behind HDHPs is that by paying a higher deductible, you’ll be more motivated to be a smart consumer when it comes to healthcare. This can lead to lower healthcare costs overall, as well as more informed decision-making about the care you receive.

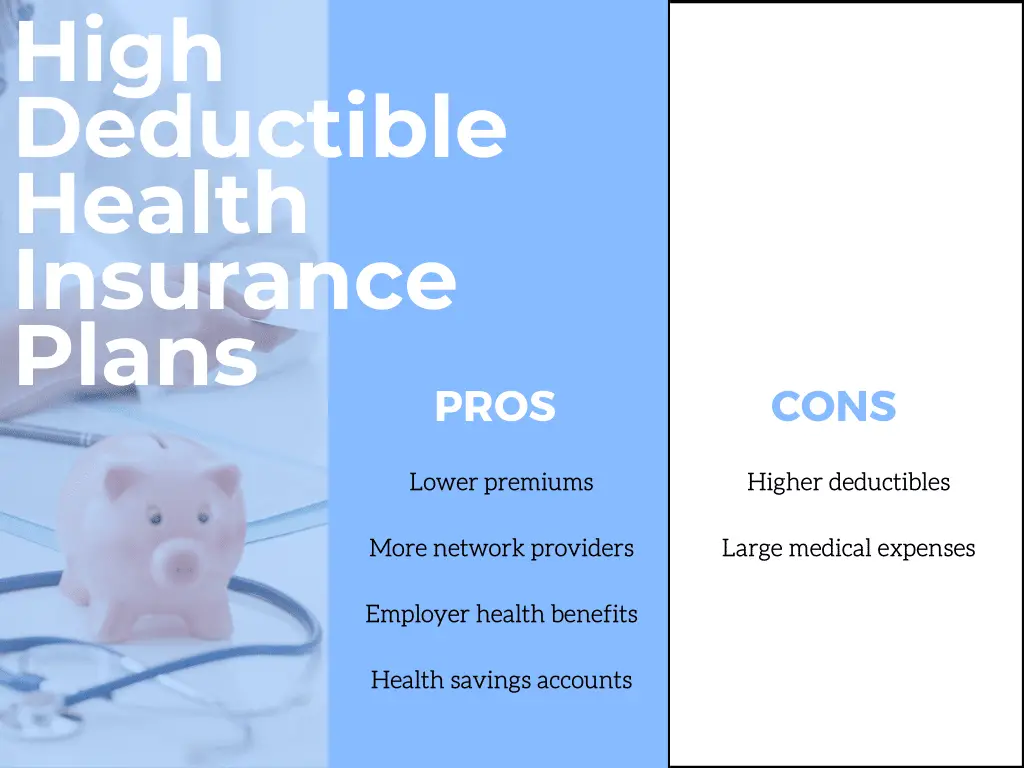

One of the most significant benefits of HDHPs is the lower premium costs. Because you’re paying a higher deductible, your monthly premium payments will be lower. This can be especially attractive to people who are relatively healthy and don’t expect to need a lot of medical care.

Another benefit of HDHPs is that they’re often paired with a Health Savings Account (HSA). An HSA allows you to set aside pre-tax money to pay for medical expenses, including your deductible. This can be a great way to save money on taxes, and the funds in your HSA can even be used for non-medical expenses in retirement.

However, HDHPs may not be right for everyone. For example, if you have a chronic health condition or take expensive medications regularly, you may end up paying more out-of-pocket with an HDHP. Additionally, if you’re not comfortable with the idea of paying a higher deductible, an HDHP may not be the best choice for you.

It’s also worth noting that HDHPs may not be the best choice for families or individuals with dependents. Because HDHPs have a higher deductible, you may end up paying more out-of-pocket for medical expenses for multiple people.

Ultimately, whether or not to choose a high-deductible health plan depends on your individual circumstances and needs. Here are a few questions to ask yourself when deciding:

- How much medical care do I expect to need in the coming year?

- Can I afford to pay a higher deductible if I need unexpected medical care?

- Are there any chronic health conditions or expensive medications that I need to factor into my decision?

- Am I eligible for an HSA, and is this a benefit that’s important to me?

If you’re comfortable with the idea of paying a higher deductible and are willing to take on a bit more risk, a high-deductible health plan may be a great option for you. However, if you’re looking for more comprehensive coverage or are concerned about out-of-pocket costs, you may want to consider other options.

Your health is one of the most important investments you’ll ever make, and choosing the right health insurance plan is a critical part of that investment. By taking the time to understand your options and carefully considering your needs, you can make an informed decision that’s right for you.