Choosing the right car insurance deductible – it’s not the most glamorous topic, but an essential one to ensure you’re adequately protected in case of an accident or theft. Think of your deductible as the gateway to your car insurance benefits. It’s the amount you must pay out of pocket before your insurance kicks in. So, how do you choose the right deductible for your needs? Let’s break it down.

First, let’s define what a deductible is and how it works. A deductible is the predetermined amount you must pay for each claim you file with your insurance company. For example, if you have a $500 deductible and your car damages total $2,000, you’ll pay the first $500, and your insurance will cover the remaining $1,500.

Now that we’ve got the basics covered, let’s dive into the factors you should consider when choosing the right deductible for your car insurance.

Check Your Finances

Before selecting a deductible, take stock of your financial situation. Can you afford to pay a higher deductible in case of an emergency, or would a lower deductible be more manageable? Consider setting aside a portion of your emergency fund to cover potential deductibles.

Assess Your Driving Record

If you’re a careful driver with a clean record, you may be comfortable with a higher deductible. On the other hand, if you’ve had accidents in the past or have tickets on your record, a lower deductible might be a better choice.

Evaluate Your Vehicle’s Value

The value of your vehicle plays a significant role in choosing a deductible. If you drive a new or expensive car, a lower deductible will help minimize your financial burden in case of an accident. Conversely, if you own an older or less valuable vehicle, a higher deductible might be more cost-effective.

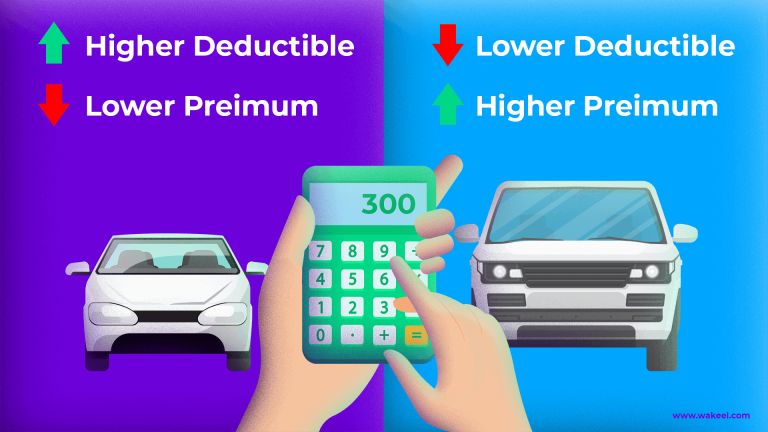

Consider the Premium-Deductible Tradeoff

When choosing a deductible, remember that it’s a tradeoff with your insurance premium. A lower deductible usually means higher premiums, while a higher deductible means lower premiums. So, weigh the pros and cons and decide what’s most important to you: affordability or financial cushion.

Common Deductible Options

Here are some common deductible options to consider:

- $250 – $500 (low deductible): Suitable for those who want to minimize out-of-pocket expenses in case of an accident.

- $500 – $1,000 (medium deductible): A good balance between affordability and premium savings.

- $1,000 – $2,000 (high deductible): Best for those who are confident in their driving skills and want to save on premiums.

Tips for Choosing the Right Deductible

- Don’t automatically choose the lowest deductible; consider your financial situation and driving record.

- Be aware that some states require a minimum deductible for certain types of coverage.

- If you have a garage or a secure parking location, you may be able to opt for a higher deductible.

- Some insurance providers offer deductible waivers or diminishing deductibles for loyal customers or those who complete defensive driving courses.

Ultimately, the right deductible for you will depend on your unique circumstances. Take the time to assess your finances, driving record, and vehicle’s value to make an informed decision. By doing so, you’ll ensure that you’re adequately protected in case of an accident or theft, and you’ll save on premiums in the long run.

So, what deductible will you choose? Will it be a low, medium, or high deductible? Remember, your deductible is the gateway to your car insurance benefits. Take the time to get it right, and drive with peace of mind knowing you’re protected on the road.