Renters insurance – it’s not exactly the most exciting topic, but trust me, it’s worth getting familiar with, especially if you’re a renter. Think about it: you’ve got a lot of stuff, and if something were to happen to your apartment, you’d want to make sure you can replace or recover your belongings, right? That’s where renters insurance comes in.

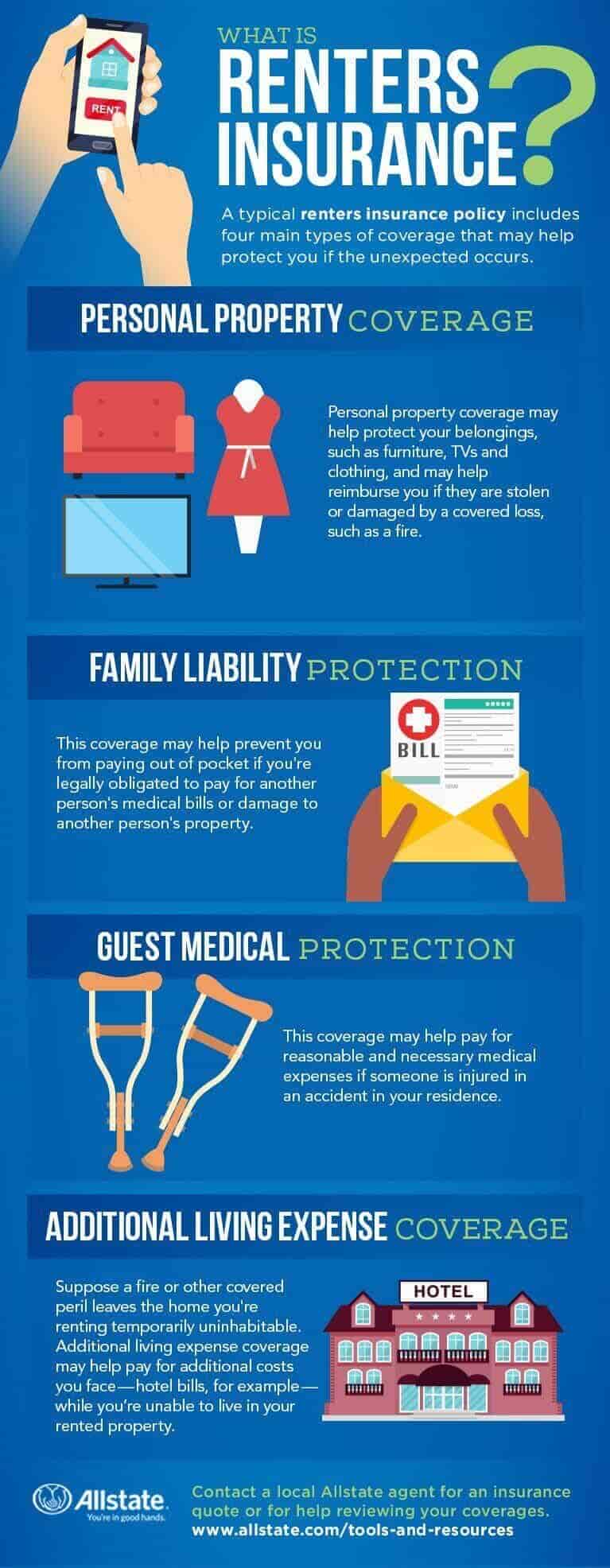

First things first: what exactly is renters insurance? Well, it’s a type of insurance that protects your personal belongings in case of damage or loss due to things like theft, fire, or natural disasters. It’s different from homeowners insurance, which covers the actual building or structure of the property.

Now, let’s talk about why you might need renters insurance. Do you have expensive electronics, jewelry, or artwork? What about a fancy bike or musical instrument? If so, you’ll want to make sure you’ve got coverage for those items in case something happens. Plus, renters insurance can also help cover temporary living expenses if you need to move out of your apartment while repairs are being made.

Here’s the good news: renters insurance is pretty affordable. The average cost is around $15-30 per month, depending on where you live and what type of coverage you choose. Of course, that’s just a rough estimate – your actual costs may vary.

Now that you know a bit more about renters insurance, let’s talk about what you should be looking for in a policy. Here are some things to consider:

- Coverage limits: Make sure you’ve got enough coverage to replace or recover the value of your belongings.

- Deductible: This is the amount you’ll need to pay out-of-pocket before your insurance kicks in.

- Liability coverage: This will protect you in case someone is injured on your property and sues you.

- Additional coverage: Depending on where you live, you might want to consider additional coverage for things like earthquake damage or flood insurance.

When shopping for renters insurance, make sure to read the fine print and ask plenty of questions. You’ll want to know what exactly is covered, what’s not, and any exclusions or limitations. Some common exclusions include flood damage, earthquake damage, and damage caused by neglect or poor maintenance.

Now, I know what you’re thinking: "Do I really need renters insurance?" The answer is: it depends. If you’re just starting out and don’t have much in terms of expensive belongings, you might not need it. But if you’ve got a lot of valuable stuff or you’re living in an area prone to natural disasters, it’s definitely worth considering.

Finally, here’s a pro tip: take inventory of your belongings before you buy renters insurance. Make a list of your valuables and their estimated values. This will come in handy if you ever need to make a claim.

In conclusion, renters insurance is an important consideration for anyone renting a place. It can provide peace of mind and financial protection in case something goes wrong. By understanding what renters insurance covers, how it works, and what to look for in a policy, you can make an informed decision about whether or not to get coverage.