Unpacking the Advantages of Being Insured: Why Renters Need Protection Too

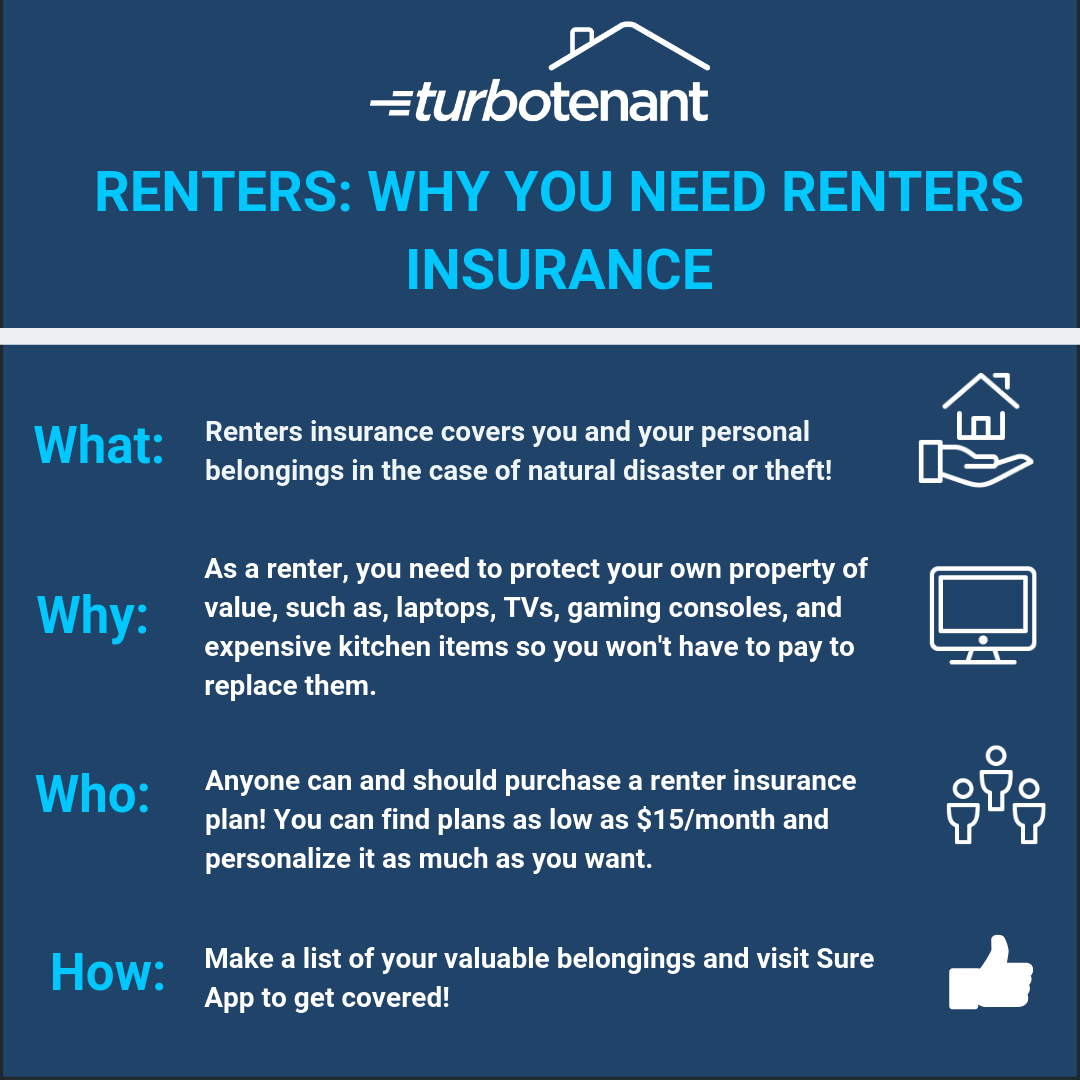

When it comes to insurance, many renters assume they don’t need it since they don’t own the property. However, this line of thinking can leave individuals vulnerable in the event of unforeseen circumstances. Renters insurance provides a safety net that not only protects personal belongings but also offers liability coverage and financial security. In this article, we’ll delve into the benefits of renters insurance, exploring why it’s a valuable investment for anyone renting a property.

Imagine coming home to discover that your apartment has been burglarized, with irreplaceable items such as family heirlooms and electronics stolen. This scenario could be financially devastating, leaving the renter to foot the bill for replacing the stolen goods. However, with renters insurance, policyholders can breathe a sigh of relief. This insurance provides coverage for personal belongings, helping to replace or repair stolen or damaged items, even if they’re outside the home or while traveling.

Another advantage of renters insurance is liability coverage. Picture this: you have friends over for dinner, and someone accidentally knocks over a candle, causing a fire that damages the property. The aftermath can be financially crippling, especially if the renter is found liable. Renters insurance takes care of this potential headache by covering damages to the property and resulting medical expenses. In many cases, the insurance also helps with legal fees if the renter is sued.

But that’s not all. Renters insurance also offers protection against temporary displacement. Imagine that your apartment becomes uninhabitable due to a burst pipe or other catastrophe. Where would you go? With this insurance, policyholders can receive financial assistance to cover temporary housing and related expenses, ensuring they can weather the storm.

Now that we’ve explored some of the key benefits of renters insurance, the question on everyone’s mind is: what does it typically cover? At its core, a standard policy provides coverage for:

- Personal belongings, including furniture, electronics, and jewelry

- Renters’ personal liability for accidents and damages

- Reimbursed expenses related to accidental property damage

- Guest medical expenses and medical bills for unexpected incidents

- Temporary housing and living expenses due to property damage

Of course, every policy is different, so be sure to review what’s covered in your own package.

While it is true the yearly cost of renters insurance is typically low, under a couple of hundred dollars, the benefits can vastly outweigh the costs. When considering protection, one main thing to think about for a renter is budget. How much will you need to spend in order to feel safe? There is a package out there that can fit almost any budget. So don’t wait until disaster strikes and leave it up to chance – make sure your peace of mind by making sure you get protection.

In conclusion, investing in renters insurance is one of the smartest financial decisions you can make as a renter. By understanding the benefits and complexities of renters insurance, individuals can better safeguard their valuables and enjoy a stress-free existence. So why not explore the world of renters insurance today and experience the tranquility that comes with being protected?