Long-term care insurance can be a puzzle, leaving you to wonder if it’s worth the investment. You’re probably thinking about your future and whether or not you’ll need this type of coverage. However, before we dive into the costs, let’s define what long-term care insurance is.

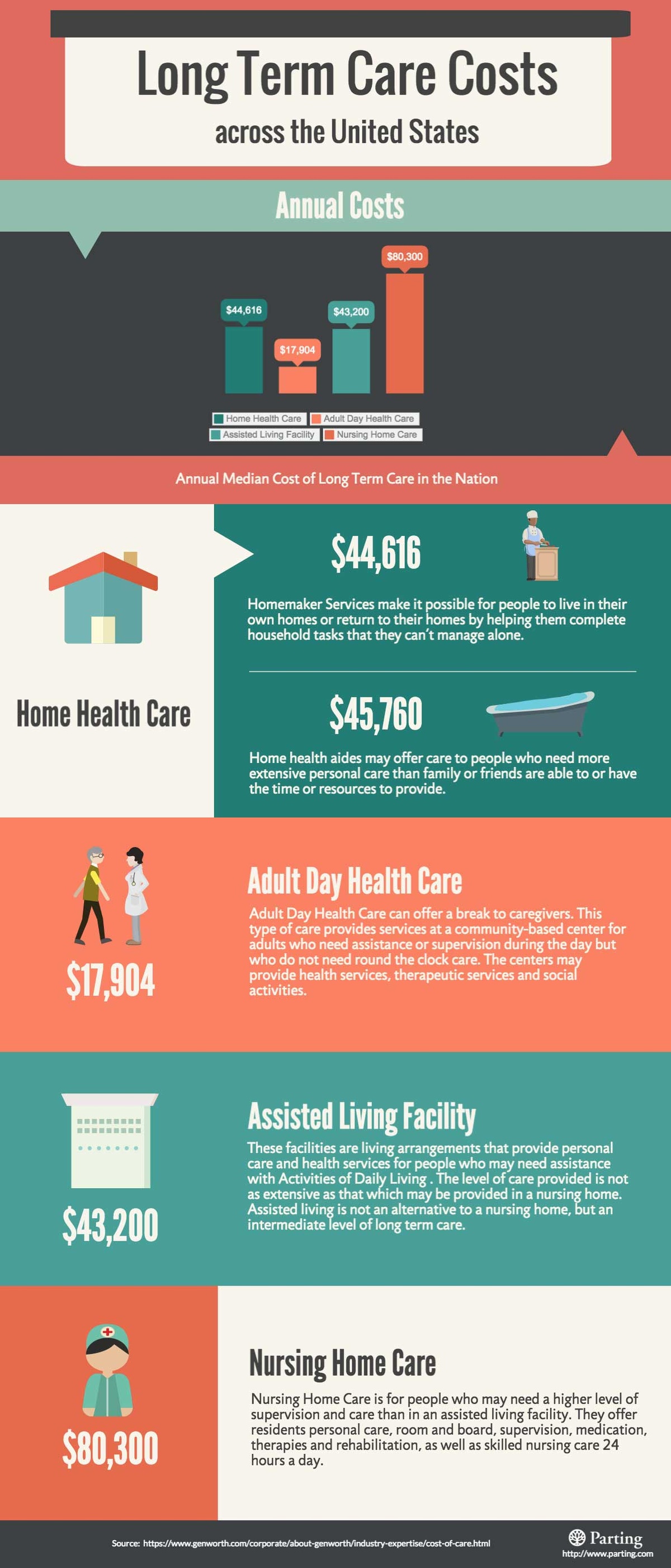

Simply put, long-term care insurance is designed to help pay for extended care that goes beyond medical care and nursing care during a prolonged illness, disability, or an ongoing cognitive impairment. This type of insurance typically covers expenses related to daily living activities like bathing, dressing, eating, and other daily activities. Some policies might also cover costs related to facility care such as a nursing home or an adult daycare.

Now that we know what long-term care insurance is, let’s examine how costs typically break down for this type of coverage. When evaluating the costs, several key components will impact your premium costs.

-

Age: Like with most types of insurance, your age plays a massive role in determining your premium price. Typically, the older you are when purchasing a policy, the more expensive it is. For example, if you were to purchase a policy at 50 compared to 60, the premium difference could be hundreds of dollars.

-

Sex: Some providers view women as higher risks than men for this type of coverage. With that said, when purchasing long-term care insurance as a female, your premium could be higher than that of a male.

-

Health: Your overall health also directly affects your premiums. This is especially true for individuals who smoke or are dealing with chronic health issues.

-

Inflation protection: Some insurance providers include a cost-of-living adjustment feature that allows your policy to keep pace with rising costs. However, when choosing this option, you should expect to pay higher premiums compared to having fixed coverage limits.

-

Daily benefit amount: Premium costs can be greatly affected by the amount of the benefit the provider agrees to pay. Decide what your anticipated needs might be and buy accordingly.

Some arguments can be made both in favor and against purchasing this protection.

Arguments For Long-term Care:

-

Assists with future medical expenses that you may not be able to handle out of pocket.

-

Typically doesn’t require direct payment until assistance is needed