Imagine sitting down with a financial advisor, eager to discuss your plans for the future. As you begin to explore your insurance options, two terms keep popping up: life insurance and health insurance. While both types of insurance are essential for protecting you and your loved ones, they serve distinct purposes and offer different benefits. So, what’s the difference between life and health insurance?

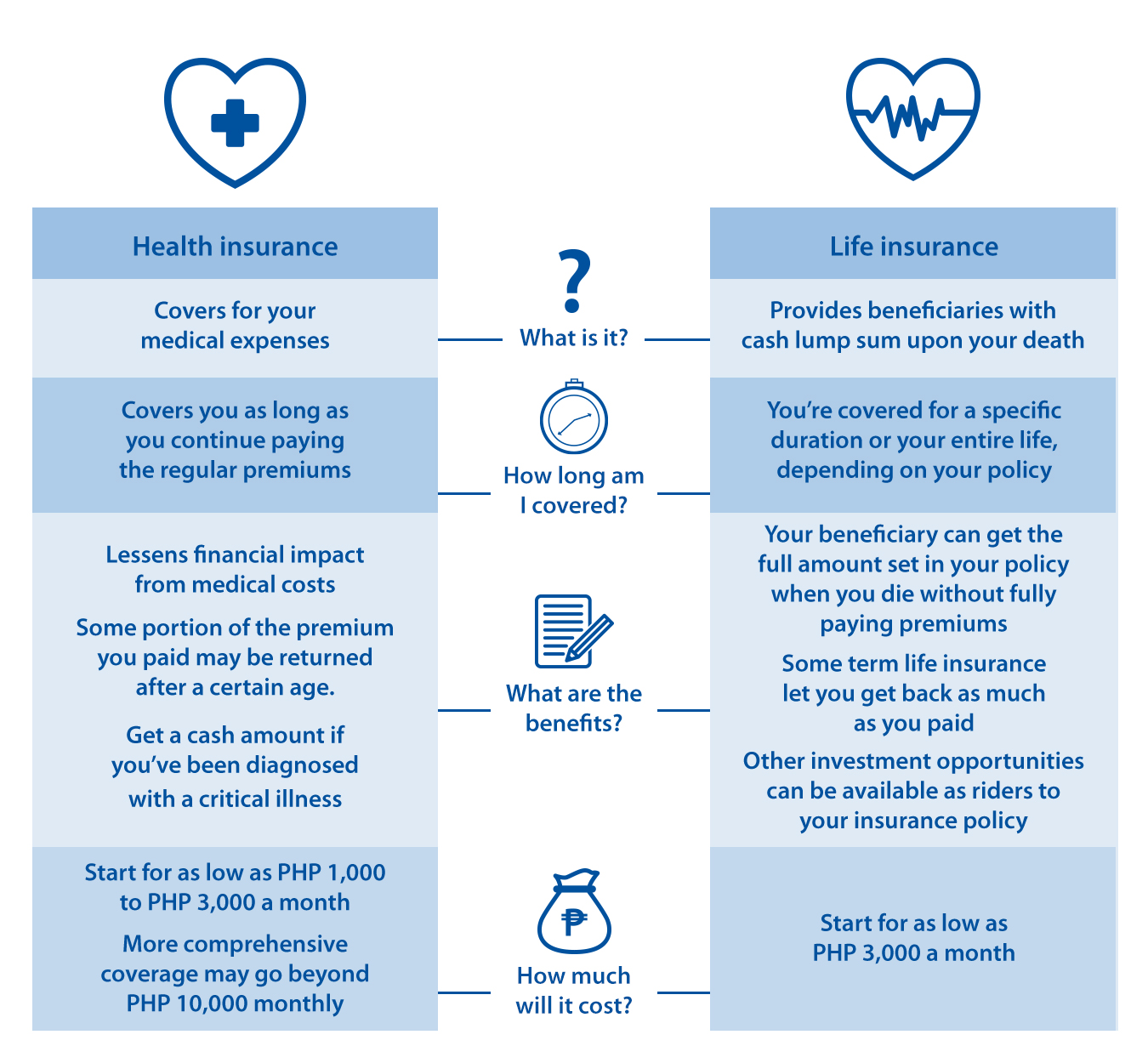

Let’s start with the basics. Life insurance is designed to provide a financial safety net for your family in the event of your passing. It’s essentially a contract between you and an insurance company, where you pay premiums in exchange for a lump-sum payment (known as a death benefit) to your beneficiaries when you die. This payment can be used to cover funeral expenses, pay off outstanding debts, or maintain your family’s standard of living.

On the other hand, health insurance is meant to help you cover the costs associated with medical care. It’s designed to minimize the financial burden of unexpected illnesses or injuries, ensuring you receive the necessary treatment without breaking the bank. Health insurance typically covers expenses like hospital stays, doctor visits, prescriptions, and surgeries.

One key distinction between life and health insurance is their purpose. Life insurance is primarily focused on ensuring your family’s financial security after you’re gone, while health insurance is geared towards keeping you alive and healthy. This fundamental difference affects everything from policy premiums to coverage options.

When it comes to policy premiums, life insurance tends to be less expensive than health insurance. This is because life insurance companies don’t have to worry about paying out benefits while you’re still alive (unless you opt for a whole life policy with a cash value component). Health insurance premiums, on the other hand, can be higher due to the ongoing costs associated with medical care.

Another significant difference between life and health insurance lies in their coverage options. Life insurance policies are generally more straightforward, with fewer add-ons and riders. Health insurance plans, however, often come with a range of customization options, such as copays, coinsurance, and deductibles.

It’s also worth noting that life insurance typically requires a medical exam as part of the underwriting process. This allows insurance companies to assess your mortality risk and adjust premiums accordingly. Health insurance plans may also require a medical exam, but it’s not always necessary.

In terms of flexibility, health insurance plans are often more adaptable to changing circumstances. For example, you can upgrade or downgrade your coverage as needed, or switch to a different plan during open enrollment periods. Life insurance policies are less flexible, as any changes to your coverage typically require applying for a new policy.

In conclusion, while both life and health insurance serve critical roles in protecting your financial and physical well-being, they cater to distinct needs and offer unique benefits. By understanding the key differences between life and health insurance, you can make informed decisions about your coverage and ensure a more secure future for yourself and your loved ones.