Have you ever wondered how insurance companies decide whether to approve your application or not? Well, that’s where underwriting comes in – a crucial process that helps insurers assess the risks associated with providing coverage to individuals or businesses.

In this article, we’ll break down the basics of insurance underwriting, exploring its various components, types, and the factors that influence underwriting decisions. Whether you’re buying insurance for the first time or just curious about how the industry works, this explanation is here to enlighten you.

What is Insurance Underwriting?

Insurance underwriting is the process by which an insurance company evaluates an individual or business’s eligibility for a policy. The goal of underwriting is to assess the level of risk associated with providing coverage and determine whether to approve or reject the application.

Underwriters – the professionals responsible for this evaluation – must carefully weigh various factors to make an informed decision. These factors may include the applicant’s medical history, lifestyle, occupation, income, credit score, and even their social media activity.

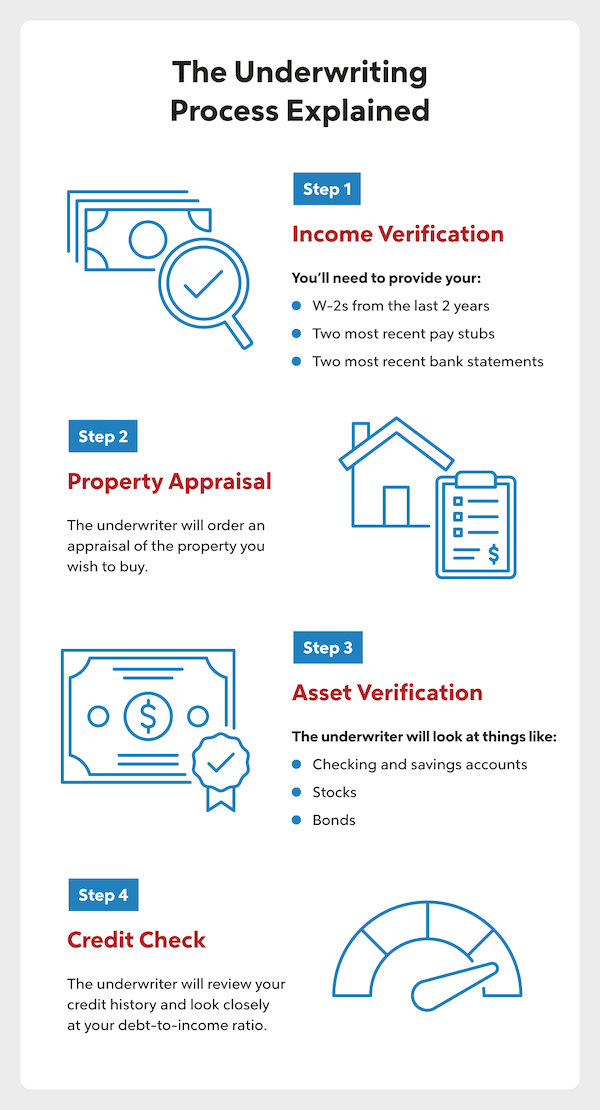

The Underwriting Process

While the underwriting process may vary depending on the type of insurance, most insurers follow a similar framework. Here’s an overview of the key steps involved:

- Application Review: The insurance company receives the application, which typically includes information about the applicant’s personal and financial details.

- Data Analysis: Underwriters analyze the application data, using statistical models and algorithms to identify potential risks.

- Risk Assessment: The underwriters evaluate the level of risk associated with the applicant, taking into account the factors mentioned earlier.

- Decision-making: Based on the risk assessment, the underwriters decide whether to approve or reject the application.

Types of Insurance Underwriting

There are two primary types of underwriting: manual underwriting and automated underwriting.

- Manual Underwriting: Traditional manual underwriting involves human underwriters reviewing applications and making decisions based on their expertise and experience.

- Automated Underwriting: This type of underwriting uses advanced algorithms and machine learning to analyze data and make decisions quickly and efficiently.

How Insurance Underwriters Make Decisions

Insurance underwriters make decisions based on a variety of factors, including:

- Medical History: The applicant’s medical history is a significant consideration in underwriting. Chronic conditions, such as diabetes or heart disease, may increase the risk of claims.

- Lifestyle: The applicant’s lifestyle choices, such as smoking or excessive drinking, can also impact underwriting decisions.

- Occupation: Certain occupations, such as construction work or firefighting, may be considered high-risk.

- Credit Score: A good credit score can demonstrate financial responsibility and reduce the risk of claims.

- Social Media Activity: Underwriters may review social media profiles to assess the applicant’s lifestyle and behavior.

Conclusion

Insurance underwriting is a critical process that helps insurers manage risk and make informed decisions about policy applications. By understanding the basics of underwriting, you can better appreciate the efforts that go into providing you with insurance coverage. Next time you apply for insurance, remember that underwriters are working behind the scenes to evaluate your application and ensure that you receive the right coverage for your needs.