Protecting Our Digital Footprint: A Guide to Maximizing Insurance Coverage

As we navigate the ever-evolving digital landscape, it’s becoming increasingly clear that our online presence is an integral part of our lives. From securing sensitive information to safeguarding cherished memories, our digital assets are worth protecting. One often overlooked aspect of digital security is insurance coverage. In this article, we’ll explore how you can utilize your insurance to shield your digital assets and provide peace of mind.

Understanding Your Current Coverage

Before diving into the specifics of digital asset protection, it’s essential to understand what your current insurance policies cover. Review your homeowner’s or renter’s insurance policies to see if they include provisions for digital assets. Some policies may include coverage for computer equipment, software, and even data recovery. However, these provisions often come with limitations and exclusions.

Cyber Insurance: The New Frontier

Cyber insurance is a relatively new type of coverage designed specifically to protect against cyber threats and digitalasset losses. These policies can provide reimbursement for expenses related to data breaches, cyber attacks, and identity theft. Cyber insurance can be purchased as a standalone policy or added as a rider to your existing homeowner’s or business insurance policy.

Types of Digital Assets to Insure

When considering what digital assets to insure, think about the sensitive information and irreplaceable items you store online. This may include:

- Personal data: Social Security numbers, credit card information, and other sensitive details.

- Digital photos and videos: Cherished memories that can’t be replaced.

- Computer equipment and software: Laptops, tablets, smartphones, and expensive software programs.

- Intellectual property: Creative works, such as manuscripts, designs, and art.

- Business data: Customer information, financial records, and trade secrets.

Maximizing Your Insurance Coverage

To maximize your insurance coverage for digital assets, follow these steps:

- Assess your digital assets: Make a list of your valuable digital assets and estimate their worth.

- Choose the right policy: Select a cyber insurance policy or add a rider to your existing policy that covers your specific digital assets.

- Read the fine print: Carefully review your policy’s exclusions, limitations, and deductibles.

- Keep records: Store your digital assets securely and maintain detailed records of your insured items.

- Stay informed: Stay up-to-date with the latest developments in cyber threats and digital asset protection.

Best Practices for Digital Asset Security

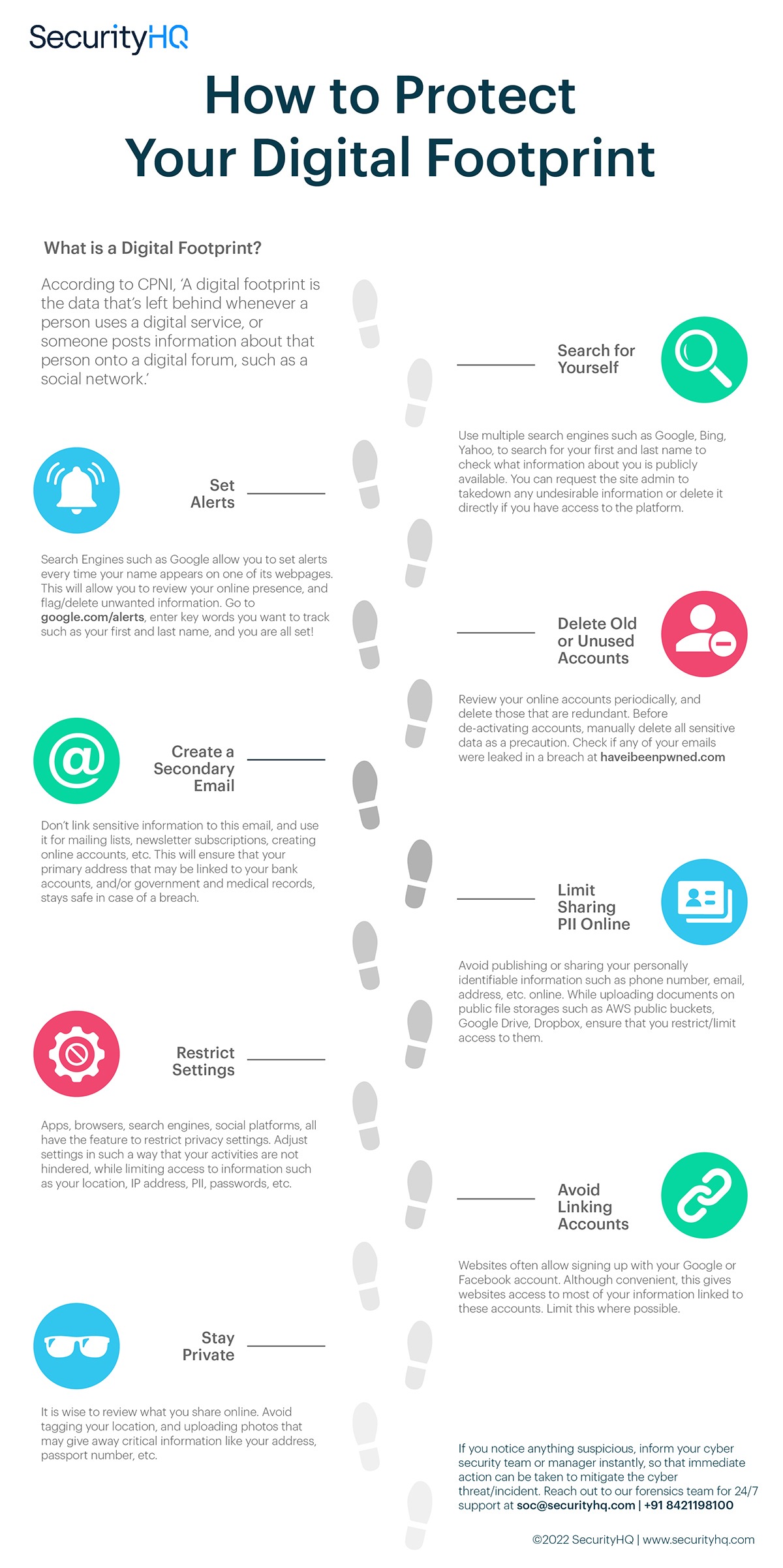

While insurance coverage is essential, it’s equally important to take proactive steps to secure your digital assets. Here are some best practices to follow:

- Use strong passwords: Use unique, complex passwords for all online accounts.

- Enable two-factor authentication: Add an extra layer of security to your accounts.

- Keep software up-to-date: Regularly update your operating system, browser, and other software.