Navigating the Complex World of Health Insurance: Weighing the Pros and Cons of Public vs Private Coverage

When it comes to securing quality healthcare, one of the most critical decisions you’ll make is choosing between public and private health insurance. With so many options available, it’s easy to feel overwhelmed by the myriad of plans, policies, and providers vying for your attention. In this article, we’ll delve into the world of public and private health insurance, exploring the benefits and drawbacks of each, to help you make an informed decision that’s right for you and your loved ones.

Public Health Insurance: A Safety Net for All

Public health insurance, also known as government-sponsored insurance, is designed to provide coverage to those who may not have access to private insurance. Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP) are examples of public health insurance programs in the United States. These programs aim to provide essential health benefits to vulnerable populations, including low-income families, children, and seniors.

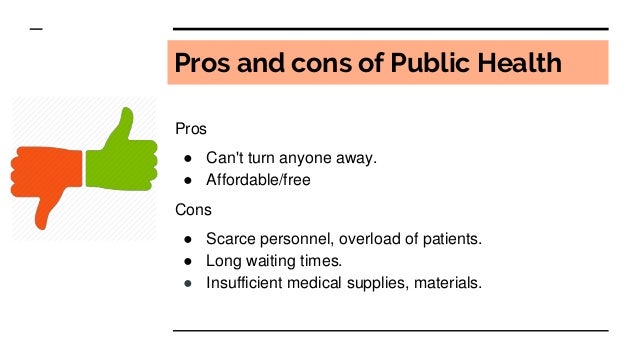

Pros of public health insurance include:

- Lower premiums and out-of-pocket costs

- Comprehensive coverage, including essential health benefits and preventive care

- Wide network of providers, including hospitals and community health centers

- No pre-existing condition exclusions

However, public health insurance programs often have income and eligibility requirements, which may limit access for some individuals. Additionally, public insurance programs may have limited provider networks and less flexibility in terms of coverage options.

Private Health Insurance: Customized Coverage for Your Needs

Private health insurance, on the other hand, is offered by insurance companies and provides coverage to individuals and families who may not be eligible for public insurance or prefer more flexibility in their coverage options. Private insurance plans can be purchased through employers, the health insurance marketplace, or directly from insurance companies.

The benefits of private health insurance include:

- Greater flexibility in coverage options, including customized plans and add-ons

- Wide range of provider networks, including specialist and out-of-network care

- More comprehensive coverage options, including dental, vision, and pharmacy benefits

- Access to top-rated hospitals and healthcare facilities

However, private health insurance typically comes with higher premiums and out-of-pocket costs. Additionally, private insurance plans may have pre-existing condition exclusions, and some plans may not offer essential health benefits.

Comparing Public and Private Health Insurance: What’s Right for You?

Ultimately, the choice between public and private health insurance depends on your individual needs, financial situation, and preferences. Consider the following factors when weighing your options:

- Income and eligibility: If you have a low income or meet specific eligibility requirements, public health insurance may be the most affordable option.

- Comprehensive coverage: If you require comprehensive coverage, including specialist and out-of-network care, private insurance may be the better choice.

- Network and flexibility: If you need access to specific providers or want more flexibility in your coverage options, private insurance may offer more advantages.

- Budget and out-of-pocket costs: If you’re on a tight budget, public health insurance may offer lower premiums and out-of-pocket costs.