Making the Most of Your Life Insurance Investment

Are you one of the millions of people who have invested in a life insurance policy to protect your loved ones and secure their future? If so, you’re taking a significant step towards ensuring that your family is financially stable, no matter what life throws their way. However, simply having a policy in place is not enough. To truly maximize its benefits, you need to understand how it works and make informed decisions about it. In this article, we’ll explore some practical tips and strategies to help you get the most out of your life insurance policy.

Choose the Right Policy for Your Needs

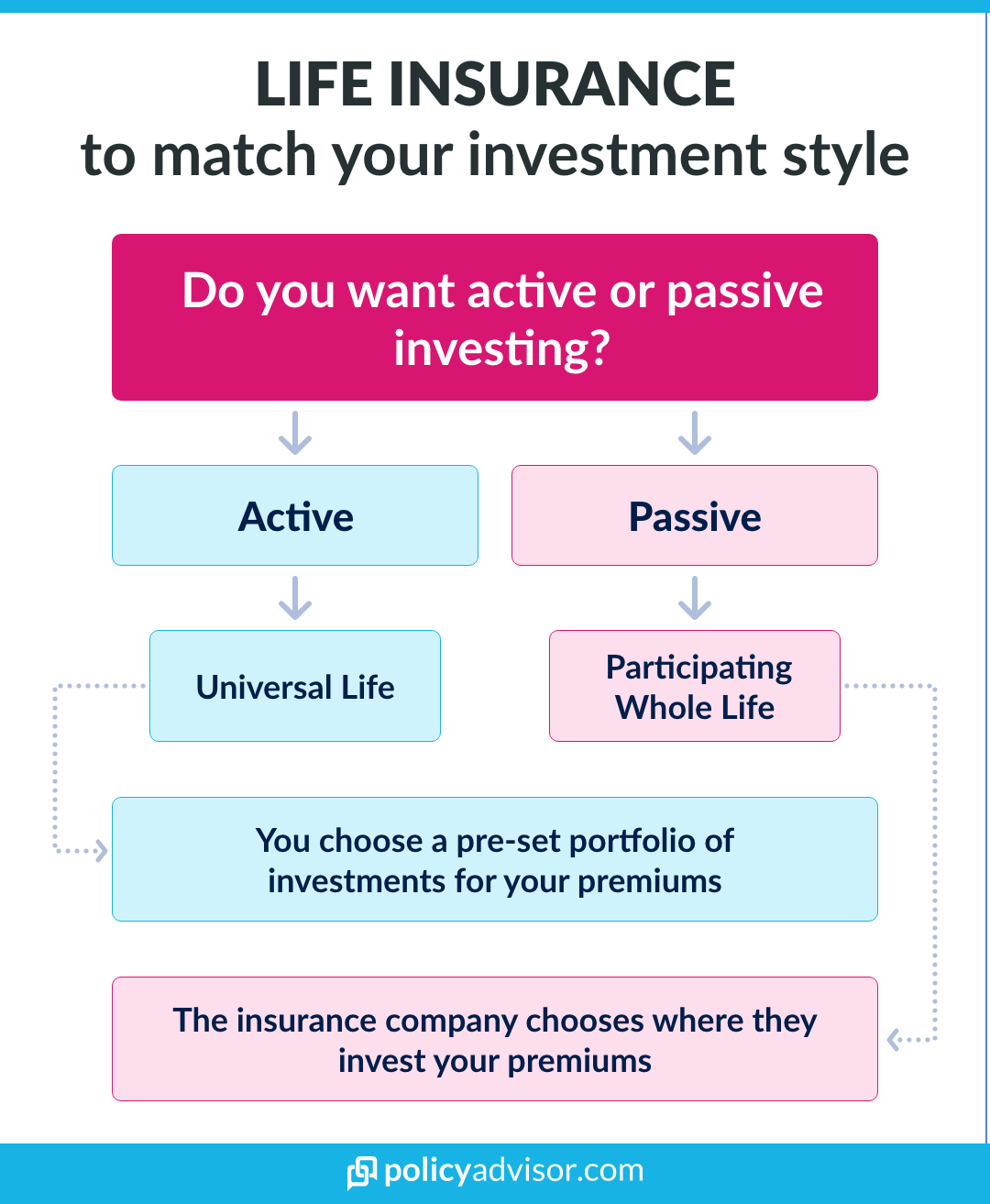

With so many types of life insurance policies available, it can be overwhelming to pick the right one. The key is to consider your individual circumstances and goals. For example, if you have young children, a term life policy might be the best option, as it provides coverage for a specific period, usually until your kids are financially independent. On the other hand, if you’re looking for a more permanent solution, whole life insurance could be the way to go. This type of policy not only provides a death benefit but also accumulates a cash value over time.

Review and Update Your Policy Regularly

Life is full of changes, and your insurance policy should evolve with you. As your circumstances change, your policy might no longer be adequate. For instance, if you get married or have children, you might need to increase your coverage. Similarly, if you pay off your mortgage or other debts, you might be able to reduce your coverage and lower your premiums. It’s essential to review your policy every few years to ensure it still aligns with your needs and goals.

Take Advantage of Riders

Riders are additional benefits that can be added to your life insurance policy to enhance its value. For example, a waiver of premium rider can waive your premiums if you become disabled or critically ill, while a long-term care rider can provide coverage for nursing home care or other long-term care expenses. Not all riders are created equal, so make sure to carefully evaluate the options available to you and choose the ones that best suit your needs.

Consider Converting Your Term Policy

If you have a term life policy that’s set to expire, you might be wondering what to do next. One option is to convert your policy to a permanent life insurance policy, such as whole life or universal life. This can be a smart move if you still need coverage and want to avoid having to re-apply for a new policy. However, be aware that converting your policy might involve higher premiums and a medical exam.

Maximize Your Cash Value

If you have a whole life insurance policy, you might be accumulating a cash value over time. This is essentially a savings component that you can borrow against or withdraw from. To maximize your cash value, make sure to pay your premiums on time and keep your policy in force. You can also consider paying more than the minimum premium to build up your cash value faster.

Don’t Forget About Dividend Payments

Some life insurance companies pay dividends to their policyholders. These are essentially profit-sharing payments that can be used to increase your death benefit or reduce your premiums. Not all policies offer dividends, so make sure to check your policy contract to see if this is an option for you.

Getting the most out of your life insurance policy requires more than just paying premiums each month. By choosing the right policy, reviewing and updating it regularly, taking advantage of riders, converting your term policy, maximizing your cash value, and exploring dividend payments, you can ensure that your investment is working hard for you and your loved ones.