Navigating the complex world of health insurance can be overwhelming, especially when you’re trying to save a buck. With premiums rising and coverage changing, it’s easy to feel like you’re stuck between a rock and a hard place. But fear not, friend – we’ve got some insider tips to help you save money on health insurance without sacrificing the coverage you need.

First things first: know your options. In the US, you’ve got a few different ways to get health insurance: through your job, on the Affordable Care Act (ACA) marketplace, or through a private insurance company. Depending on your income level, family size, and other factors, one of these options might be more affordable than the others.

If you’re getting insurance through your job, take advantage of the tax benefits. Your employer will typically contribute to your premiums, and you can also use pre-tax dollars to pay for your share of the premiums. This can shave hundreds or even thousands off your tax bill.

If you’re shopping on the ACA marketplace, don’t be afraid to get a little picky. Compare plans carefully, looking at deductibles, copays, and coinsurance rates. You might find that a higher deductible plan is actually a better deal in the long run, especially if you’re relatively healthy.

And what about private insurance companies? This route can be a bit riskier, but it might also save you some serious cash. Just be sure to do your research and choose a reputable company with a good rating.

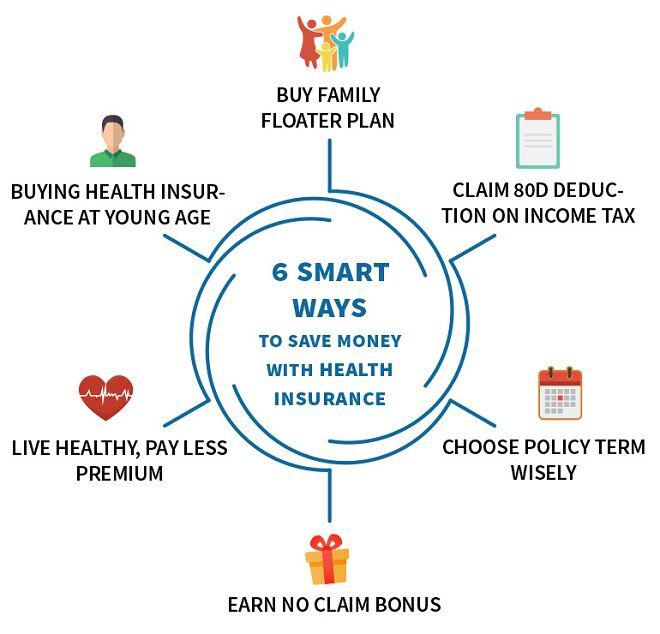

Next up: take care of your health. This one might seem obvious, but it’s worth repeating: the healthier you are, the less you’ll pay for insurance. Quit smoking, shed a few extra pounds, and get regular check-ups to keep your premiums in check.

Another often-overlooked way to save is through tax credits and subsidies. If you’re low-income or self-employed, you might be eligible for subsidies to help pay for your premiums. And if you’re not already taking advantage of the Health Savings Account (HSA) option, it’s definitely worth considering.

An HSA allows you to set aside pre-tax dollars to pay for medical expenses, and the money rolls over from year to year. This can add up to big savings over time, especially if you’ve got a high-deductible plan.

Last but not least: don’t be afraid to ask questions. Your insurance company is there to help you, so don’t be shy about picking up the phone or sending an email to ask about discounts or other cost-saving opportunities.

In conclusion, saving money on health insurance doesn’t have to be a mystery. By knowing your options, taking care of your health, and being smart about tax credits and subsidies, you can get the coverage you need without breaking the bank. Happy insuring!