Floods can be devastating, causing widespread damage to homes and businesses. Not only do they pose a significant threat to the structure and safety of your property, but they can also lead to financial ruin if you’re not adequately prepared. This is where flood insurance comes in – a vital safety net that can protect your investment and provide peace of mind. In this article, we’ll explore the ins and outs of flood insurance, and how you can use it to safeguard your property.

Why Do I Need Flood Insurance?

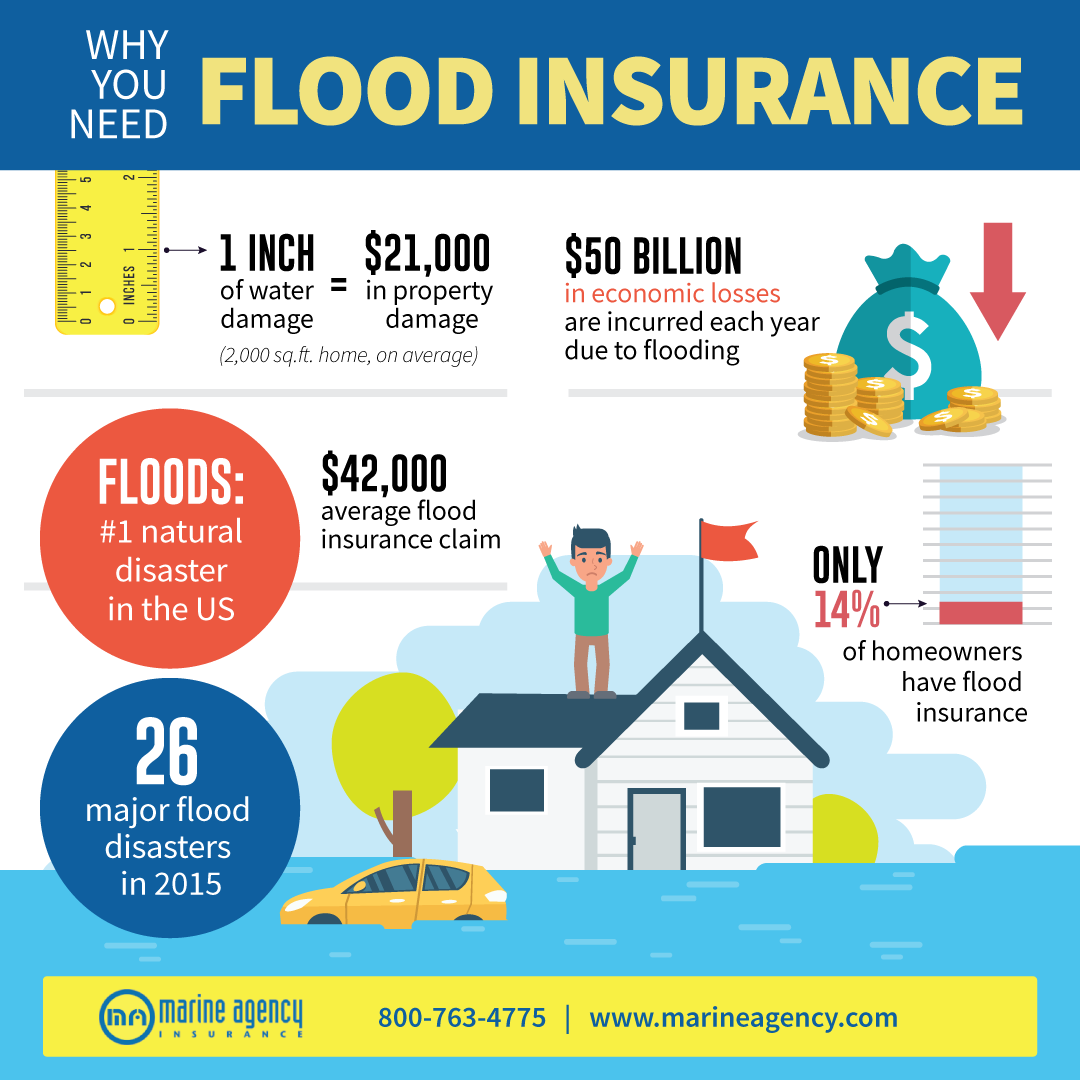

Floods can happen anywhere, and they’re not just limited to coastal areas or regions prone to heavy rainfall. In fact, floods are one of the most common natural disasters in the United States, with the Federal Emergency Management Agency (FEMA) reporting that floods affect over 90% of all natural disasters. If you’re a homeowner or business owner, it’s essential to consider flood insurance as part of your overall insurance portfolio.

What Does Flood Insurance Cover?

Unlike standard homeowners or property insurance, flood insurance is designed specifically to cover damage caused by flooding. This includes:

- Damage to the building and its foundation

- Damage to electrical and plumbing systems

- Damage to appliances and HVAC systems

- Loss of personal belongings, such as furniture and clothing

- Debris removal and cleanup costs

What Isn’t Covered?

While flood insurance provides comprehensive coverage for damage caused by flooding, there are some exclusions and limitations to be aware of:

- Damage caused by mold or mildew is typically not covered unless it’s directly related to the flood

- Damage to outdoor items, such as decks and fences, may not be covered

- Personal belongings stored in basements or below ground level may not be covered

How Much Does Flood Insurance Cost?

The cost of flood insurance varies depending on several factors, including:

- Location: Homes located in high-risk flood areas will typically pay more for flood insurance

- Property value: The value of your home or business will impact the cost of flood insurance

- Policy limits: The amount of coverage you choose will affect your premium

- Deductible: The amount you pay out-of-pocket when filing a claim will impact your premium

On average, the cost of flood insurance can range from $400 to over $10,000 per year, depending on your specific circumstances.

How to Get Flood Insurance?

If you’re interested in obtaining flood insurance, here are the steps to follow: