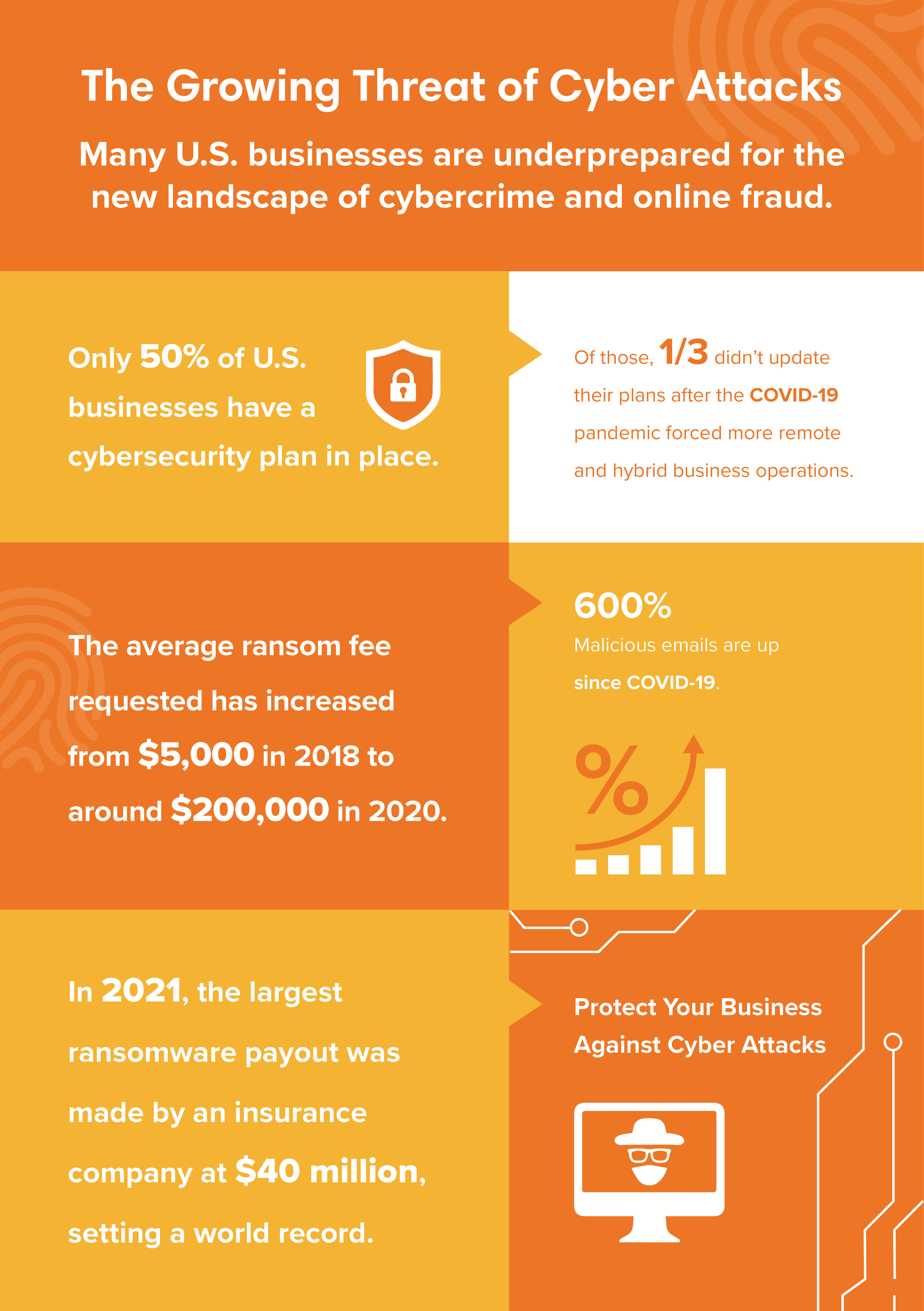

In today’s digital world, it’s no secret that cyber attacks are a growing threat to businesses of all sizes. With more and more company data moving online, it’s become a lucrative target for hackers and other cybercriminals. The consequences of a successful attack can be devastating, from financial losses and reputational damage to lost business and even bankruptcy.

While having robust cybersecurity measures in place is crucial, it’s equally important to consider the role of insurance in protecting your business from the financial fallout of a cyber attack. In this article, we’ll explore the importance of cyber insurance, what to look for in a policy, and how to make sure you’re adequately covered.

Why Cyber Insurance Matters

When a cyber attack strikes, the financial consequences can be severe. You may face costs such as:

- Notification and credit monitoring services for affected customers

- Forensic analysis and incident response to determine the scope of the breach

- Restoration of systems, data, and property

- Regulatory fines and penalties

- Reputation management and public relations

These costs can quickly add up, and even small businesses can face losses in excess of $100,000. Cyber insurance can help mitigate these costs by providing a financial safety net in the event of an attack.

What to Look for in a Cyber Insurance Policy

Not all cyber insurance policies are created equal. When shopping for coverage, look for the following key features:

- First-party coverage: This pays for damages to your business, including loss of income, data restoration, and reputational damage.

- Third-party coverage: This pays for damages to third-party vendors, partners, or customers, including credit monitoring services and regulatory fines.

- Network security coverage: This provides coverage for attacks that exploit vulnerabilities in your network or systems.

- Ransomware coverage: This provides coverage for attacks in which hackers demand payment in exchange for releasing compromised data.

- Data breach response coverage: This pays for the costs of responding to a data breach, including notification services and forensic analysis.

How to Determine the Right Level of Coverage

Determining the right level of coverage for your business requires a careful assessment of your cyber risk. Consider the following factors:

- Size and complexity of your business: Larger, more complex businesses tend to require more comprehensive coverage.

- Type of data you store: If you store sensitive data, such as financial or healthcare information, you may require more coverage.

- Industry and compliance requirements: Certain industries, such as healthcare and finance, are subject to strict regulations and may require more comprehensive coverage.

- Your cybersecurity posture: If you have robust cybersecurity measures in place, you may require less coverage.

Tips for Getting the Most Out of Your Cyber Insurance