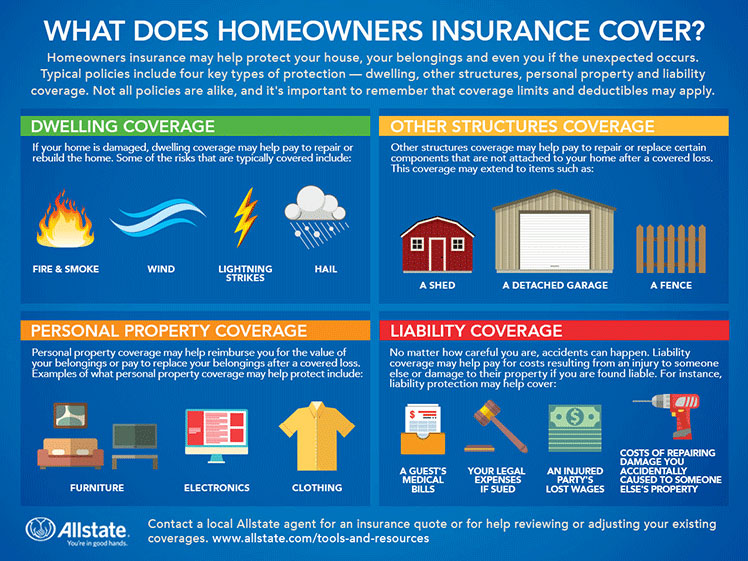

As a homeowner, one of the most important investments you can make is in a comprehensive homeowner’s insurance policy. Not only does it provide financial protection against unforeseen events like natural disasters, fires, and theft, but it also offers peace of mind knowing that you’re covered in case the unexpected happens. However, simply having a policy isn’t enough – to truly make the most of it, you need to understand what’s covered, what’s not, and how to navigate the claims process.

First Things First: Know Your Policy

Before we dive into the nitty-gritty, it’s essential to have a solid grasp of your policy’s details. Take the time to review your policy documents, paying attention to the types of coverage you have, the deductibles, and any limitations or exclusions. Some policies may offer additional features like flood insurance or coverage for valuables, so be sure to look for these.

Don’t Overlook the Obvious: Maintenance and Prevention

While homeowner’s insurance can cover damage caused by unforeseen events, it’s not a substitute for regular maintenance and upkeep. By taking care of your home, you can significantly reduce the risk of damage and costly claims. This includes tasks like:

- Regularly inspecting and replacing worn-out gutters and downspouts

- Trimming trees and shrubs to prevent branch damage

- Installing smoke detectors and carbon monoxide alarms

- Sealing cracks and gaps in walls and foundations

Document Everything: The Power of Records

When it comes to making a claim, having thorough documentation can be your best friend. Take the time to:

- Create a home inventory: Document your belongings, including their value, make, and model.

- Take photos and videos: Record your home’s condition, including any upgrades or renovations.

- Keep receipts: Store receipts for repairs, replacements, and purchases.

Navigating the Claims Process: A Step-by-Step Guide

In the event that you do need to file a claim, it’s essential to know the process like the back of your hand. Here’s a step-by-step guide:

- Assess the damage: Take photos and document the damage, making sure to include any necessary details.

- Contact your insurer: Reach out to your insurance provider, providing them with your policy number and a description of the damage.

- Complete a claims form: Your insurer will guide you through this process, which may include providing documentation and proof of ownership.

- Work with an adjuster: An insurance adjuster will be assigned to your case to assess the damage and determine the value of your claim.

- Review and settle: Carefully review the settlement offer, ensuring it accurately reflects the damage and costs.

Maximizing Your Coverage: Additional Tips and Tricks

To get the most out of your homeowner’s insurance coverage, consider the following: