Navigating the complex world of health insurance can be a daunting task, especially when it comes to deciding between a PPO and HMO plan. Both types of plans have their pros and cons, and what works for one person may not work for another. In this article, we’ll break down the key differences between PPO and HMO plans, and provide you with the information you need to make an informed decision.

What’s the Difference Between PPO and HMO Plans?

Before we dive into the nitty-gritty details, let’s start with the basics. Both PPO and HMO plans are types of managed care plans, which means they contract with a network of healthcare providers to offer discounted rates to plan members.

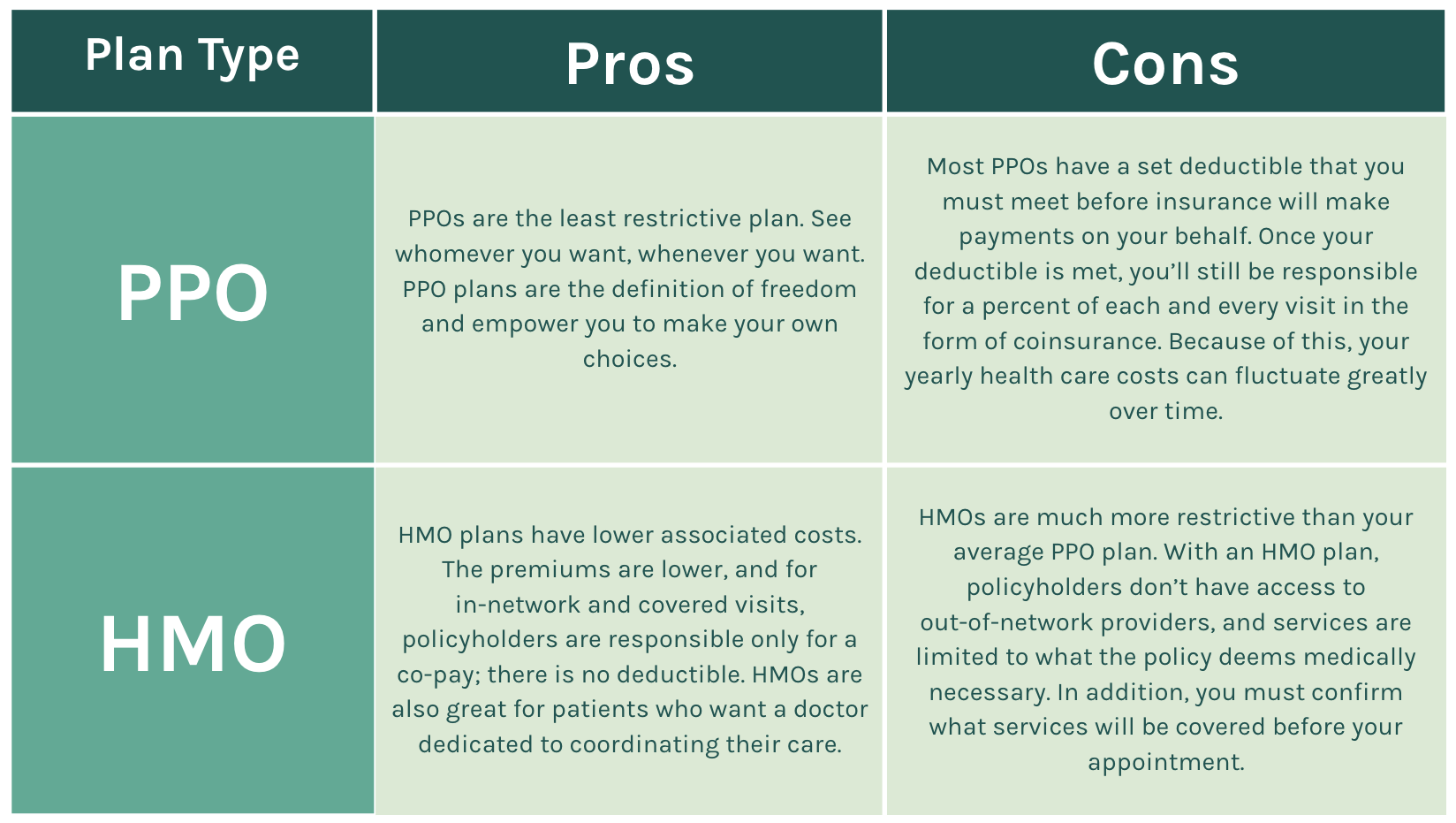

A PPO, or Preferred Provider Organization, plan allows you to see any healthcare provider, whether they’re in-network or not. You’ll typically pay more for out-of-network care, but you have the freedom to choose your own doctors. PPO plans also usually don’t require a primary care physician (PCP) referral to see a specialist.

An HMO, or Health Maintenance Organization, plan, on the other hand, is a more restrictive type of plan. With an HMO plan, you’re required to see a PCP who coordinates all your care, including referrals to specialists. If you want to see a specialist, you’ll need to get a referral from your PCP first. HMO plans also usually have a smaller network of healthcare providers, which can be a drawback if you live in a rural area or prefer to see certain specialists.

Key Considerations When Choosing Between PPO and HMO Plans

So, how do you decide between a PPO and HMO plan? Here are some key considerations to keep in mind:

- Network size: If you have a favorite doctor or specialist, check to see if they’re in the plan’s network. If they’re not, a PPO plan might be a better choice.

- Out-of-network costs: If you think you’ll need to see an out-of-network provider, consider a PPO plan. Out-of-network costs can add up quickly with an HMO plan.

- PCP referrals: If you don’t want to be required to see a PCP before seeing a specialist, a PPO plan might be a better choice.

- Cost: Ultimately, the cost of the plan will be a major factor in your decision. PPO plans are often more expensive than HMO plans, but they offer more flexibility.

- Healthcare needs: If you have ongoing healthcare needs, an HMO plan might be a better choice. HMO plans often have better coverage for preventive care and chronic condition management.

Real-Life Scenarios to Help You Decide

Let’s say you have a chronic condition, like diabetes, and need to see a specialist regularly. An HMO plan might be a better choice, as it will likely have better coverage for ongoing care and chronic condition management.

On the other hand, if you’re relatively healthy and don’t need to see a doctor often, a PPO plan might be a better choice. You’ll have more flexibility to choose your own doctors, and you won’t be required to see a PCP before seeing a specialist.

The Bottom Line

Choosing between a PPO and HMO plan can be a tough decision, but it ultimately comes down to your individual needs and preferences. Consider your healthcare needs, budget, and lifestyle when making your decision.

If you want more flexibility and don’t mind paying a bit more, a PPO plan might be a better choice. But if you’re looking for a more affordable option with better coverage for preventive care and chronic condition management, an HMO plan might be the way to go.

Remember, there’s no one-size-fits-all solution when it comes to health insurance. Take the time to research and compare plans, and don’t be afraid to ask questions before making a decision.