Ever wondered how auto insurance companies determine the amount you pay for premiums? It’s a complex process, but we’re about to break it down for you. Think of it like solving a puzzle – several factors are taken into account to arrive at a final number. Let’s dive in and explore the world of auto insurance calculations.

First, it’s essential to understand that insurance companies aim to assess the level of risk associated with insuring you. They do this by evaluating various aspects of your life, driving habits, and vehicle. The higher the risk, the higher your premium is likely to be.

So, what are these magic factors that insurance companies use to calculate your premium?

1. Your Vehicle: A Key Player in Premium Calculation

Your vehicle plays a significant role in determining your premium. Here are a few reasons why:

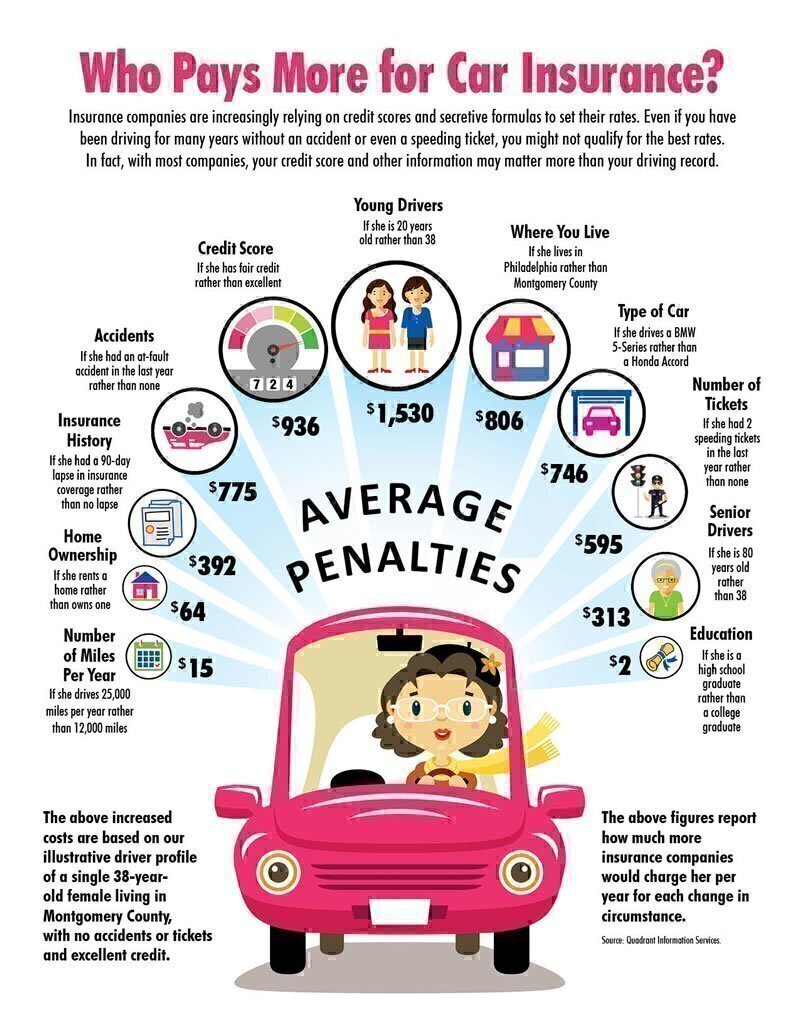

- Vehicle type: Sports cars, luxury vehicles, and high-performance cars are typically more expensive to insure. This is because they’re more likely to be involved in accidents, and repairs can be costly.

- Vehicle value: The more valuable your car, the more it’ll cost to replace or repair it. This translates to higher premiums.

- Safety features: Vehicles equipped with advanced safety features like lane departure warning systems, blind-spot detection, and automatic emergency braking may qualify for lower premiums.

2. Your Driving History: A Record Speaks a Thousand Words

Your driving history is a crucial factor in determining your premium. Here’s why:

- Accidents: If you’ve been involved in accidents, your premium will likely increase. This is because you’re deemed a higher risk driver.

- Traffic tickets: Speeding tickets, reckless driving, and other traffic infractions can also raise your premium.

- Claims history: If you’ve made claims in the past, your premium may increase.

3. Your Location: Where You Live Matters

Where you live can significantly impact your premium. Here are a few reasons why:

- Urban vs. rural: If you live in an urban area, your premium may be higher due to increased traffic congestion, crime rates, and accident rates.

- High-crime areas: If you live in an area prone to car theft or vandalism, your premium may increase.

- Natural disaster zones: If you live in an area prone to natural disasters like hurricanes, earthquakes, or floods, your premium may be higher.

4. Your Credit Score: A Surprising Factor

Your credit score can also impact your premium. Here’s why:

- Credit history: Insurance companies believe that individuals with poor credit history are more likely to file claims.

- Payment history: If you have a history of missed payments, your premium may increase.