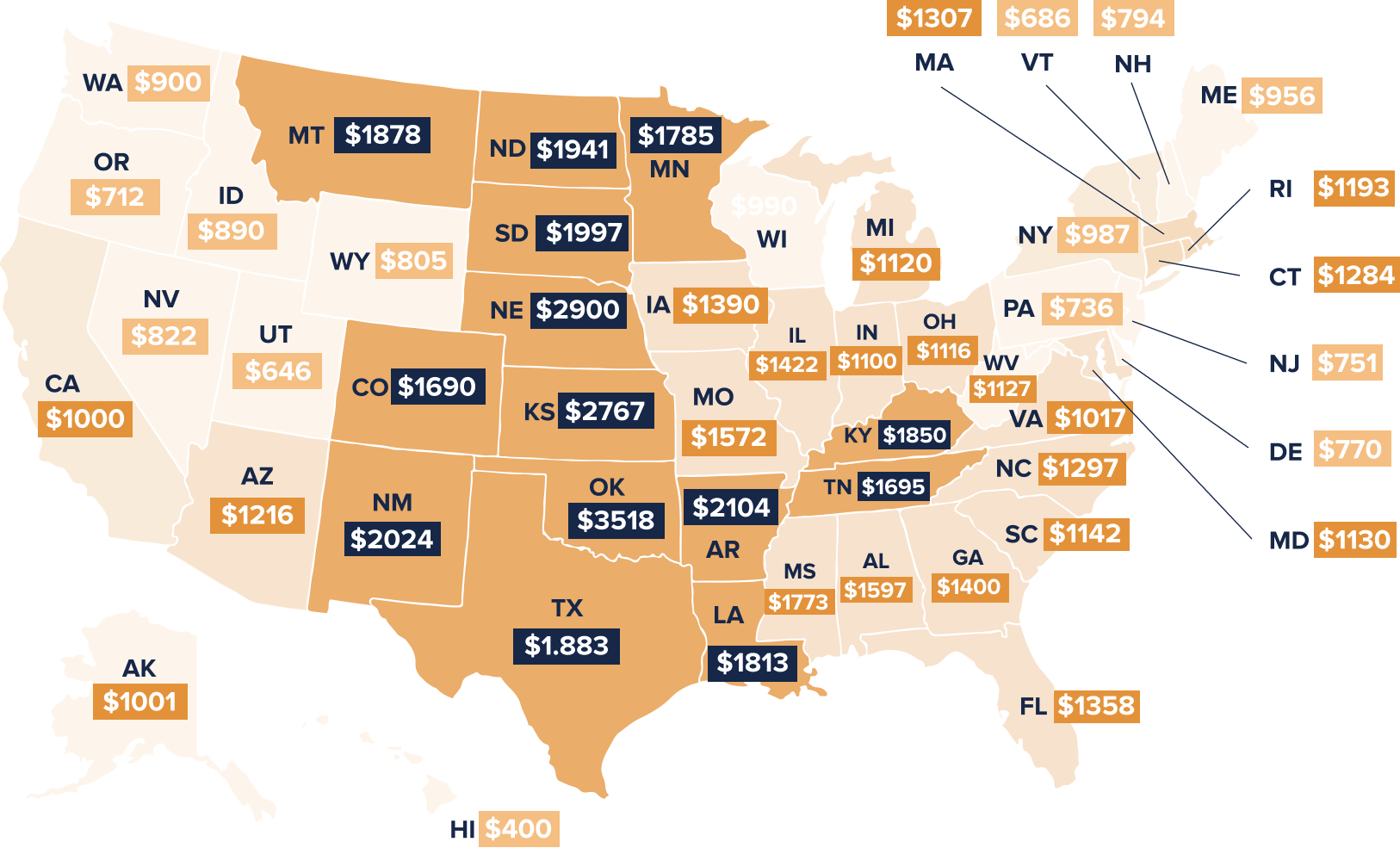

Geography Plays a Big Role in How Much You Pay for Home Insurance

If you live in a coastal area, you might already be aware that your home insurance premiums are likely higher than those of your friends who live in a landlocked state. But did you know that geography plays a much bigger role in determining your home insurance rates than just whether you live near water?

From natural disasters to climate conditions, the location of your home can significantly impact your insurance premiums. In this article, we’ll break down how different geographical factors can influence your home insurance policy and what you can do to minimize the costs.

Natural Disasters: Earthquakes, Hurricanes, and Wildfires

If you live in an area prone to natural disasters, such as California (earthquakes), Florida (hurricanes), or Colorado (wildfires), your insurance premiums will likely be higher. Insurance companies use data and statistics to determine the likelihood of a disaster occurring in your area and adjust your rates accordingly.

For example, if you live in a high-risk earthquake zone, your insurance company may charge you more for earthquake coverage. The same goes for hurricane or wildfire coverage in areas where these disasters are more common.

Climate Conditions: Weathering the Storm

Climate conditions also play a significant role in determining your home insurance rates. If you live in an area with extreme temperatures, high winds, or heavy rainfall, your insurance premiums may be higher.

For instance, if you live in a state like Oklahoma, where tornadoes are common, your insurance company may charge you more for windstorm coverage. Similarly, if you live in a state like North Dakota, where winters are harsh and cold, your insurance company may charge you more for freeze damage coverage.

Proximity to Bodies of Water: The Coastal Effect

As mentioned earlier, living near a body of water, whether it’s the ocean, a lake, or a river, can significantly impact your home insurance rates. This is because homes near water are more susceptible to flooding, storm surges, and water damage.

However, it’s not just coastal areas that are affected by water. If you live near a river or a lake that’s prone to flooding, your insurance company may charge you more for flood insurance.

Elevation: The Higher You Go, the Lower Your Rates

While it may seem counterintuitive, living at a higher elevation can actually decrease your home insurance rates. This is because homes at higher elevations are less susceptible to flooding and storm surges.

However, homes at high elevations may be more prone to wildfires and other types of damage, so it’s essential to weigh the risks and benefits before moving to a higher elevation area.

Nearness to Emergency Services: The Proximity Effect

If you live in an area with a high concentration of emergency services, such as fire stations and hospitals, your insurance premiums may be lower. This is because insurance companies assume that emergency services can respond more quickly and effectively in areas with a high concentration of services.

On the other hand, if you live in a rural or remote area, your insurance premiums may be higher due to the lack of nearby emergency services.

What You Can Do to Minimize the Costs

While you can’t control the geography of your area, there are steps you can take to minimize the costs of your home insurance policy:

Shop Around: Compare insurance quotes from multiple providers to find the best rates for your area.

Install Storm Shelters: If you live in an area prone to natural disasters, consider installing a storm shelter or safe room to reduce your insurance premiums.

Elevate Your Home: If you live in a flood-prone area, consider elevating your home to reduce the risk of flooding.

Use Durable Materials: Use durable materials, such as metal roofing and siding, to reduce the risk of damage from natural disasters.

In conclusion, geography plays a significant role in determining your home insurance rates. From natural disasters to climate conditions, the location of your home can impact your premiums in many ways.

By understanding how geography affects your home insurance policy, you can take steps to minimize the costs and ensure that your home is protected against the unexpected.