Choosing the Right Deductible for Your Ride: A Step-by-Step Guide

When it comes to car insurance, the deductible is an essential aspect to consider. It’s the amount you’ll need to pay out-of-pocket when filing a claim, and choosing the right deductible can make a significant difference in your overall insurance costs. However, deciding on the optimal deductible can be a daunting task, especially for those new to the world of insurance.

Let’s break down the process of determining your car insurance deductible into manageable steps. This will help you make an informed decision that suits your financial situation and driving habits.

Understanding What a Deductible Means

A deductible is essentially a predetermined amount that you’ll need to pay when filing an insurance claim. For instance, if your deductible is $500 and the repair cost is $2,500, you’ll need to pay the first $500, and your insurance provider will cover the remaining $2,000.

Factors to Consider When Choosing a Deductible

Before choosing a deductible, you’ll want to consider several factors. These include:

- Your Financial Situation: Consider your savings and emergency fund. If you have enough set aside to cover potential repairs, you may want to opt for a higher deductible.

- Your Driving Habits: If you have a safe driving record and rarely file claims, a higher deductible might be a suitable option for you.

- The Age and Value of Your Vehicle: If you own an older vehicle or one with a lower market value, a higher deductible might be more feasible.

- Your Tolerance for Risk: Consider your level of risk tolerance. If you’re comfortable assuming a higher level of risk, you might opt for a higher deductible.

Step 1: Evaluate Your Savings and Emergency Fund

Review your current savings and emergency fund to determine how much you can afford to pay out-of-pocket in the event of a claim. Consider setting aside a separate fund specifically for car-related expenses, as this can help alleviate some of the financial burdens.

Step 2: Assess Your Driving Habits and History

Take a close look at your driving record. If you have a history of accidents or frequent claims, a lower deductible might be a better option for you. Additionally, consider your daily driving habits. If you drive long distances or in heavy traffic, a lower deductible might be more suitable.

Step 3: Consider the Age and Value of Your Vehicle

Evaluate the age and market value of your vehicle. If you own an older vehicle or one with a lower market value, a higher deductible might be more feasible.

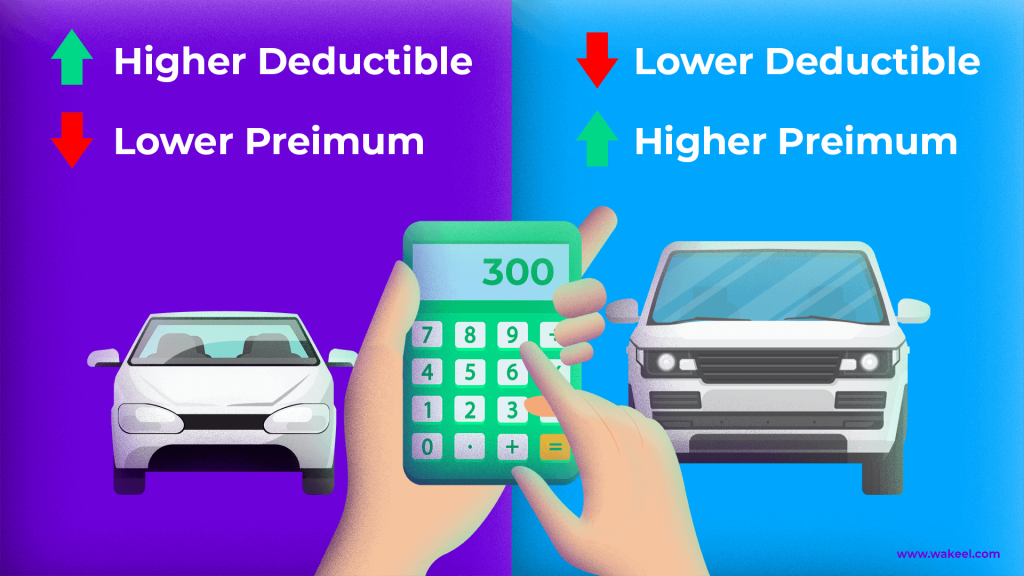

Step 4: Calculate the Potential Premium Savings

Consider the potential premium savings by opting for a higher deductible. Keep in mind that these savings might not be substantial enough to warrant a higher deductible, depending on your individual circumstances.

Making an Informed Decision

After evaluating these factors and steps, you’re better equipped to make an informed decision about your deductible. It’s essential to weigh the pros and cons of a higher deductible against your individual circumstances.

While a lower deductible may provide added security and peace of mind, a higher deductible might result in significant premium savings over time. Don’t underestimate the importance of your deductible – it’s a crucial element in ensuring your insurance coverage is tailored to your unique needs.

Choosing the optimal deductible requires a careful consideration of your financial situation, driving habits, and the age and value of your vehicle. By following these steps and evaluating your individual circumstances, you can make a smart and informed decision that works best for you.